Investing in UK property from overseas presents a unique set of challenges. You want to capitalize on a strong market, but you can’t just pop over to view a location or meet a contractor. Success depends entirely on having a clear strategy and a trusted team on the ground. How do you perform due diligence from thousands of miles away? How do you ensure your investment is managed effectively? This guide is built for investors like you. We’ll cover the essential steps for finding and securing profitable buy to let properties for sale, even from a distance, and show you how to build a hands-off portfolio that generates returns without the stress.

Key Takeaways

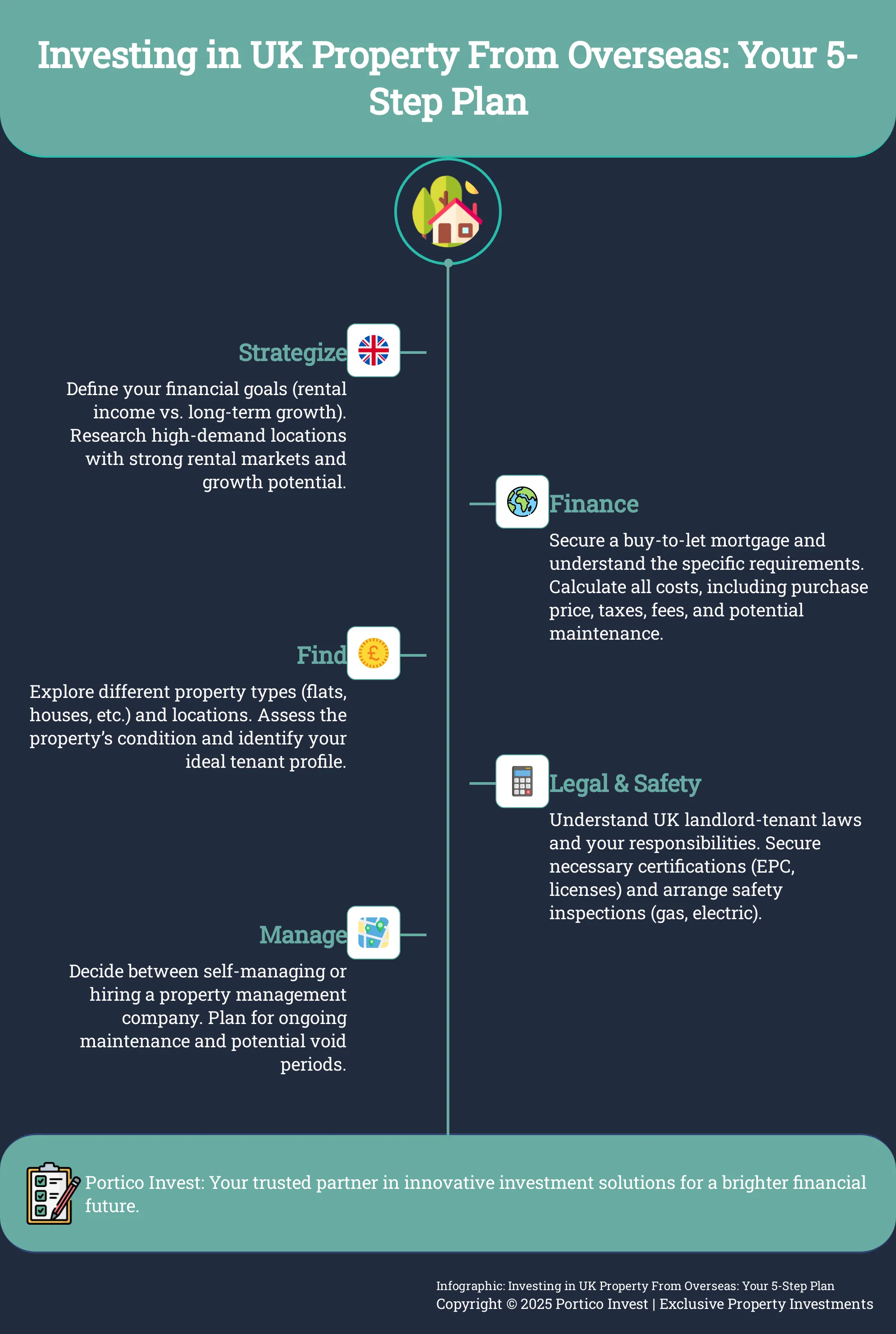

- Plan your investment before you browse properties: Define your financial goals, like monthly income or long-term growth, and identify high-demand locations to ensure your search is focused and strategic from the start.

- Account for all costs, not just the purchase price: A successful investment requires budgeting for the full picture, including stamp duty, legal fees, ongoing maintenance, and potential void periods, to get a true sense of your profitability.

- Prepare for your role as a landlord: Being a landlord is an active role that requires staying on top of legal and safety rules, having a solid tenant screening process, and deciding whether to self-manage or hire a professional for a hands-off experience.

What Is a Buy to Let Property?

If you’re exploring property investment, you’ve likely come across the term “buy to let.” It’s a popular strategy for building wealth, but it’s important to understand exactly what it involves before you get started. At its core, a buy to let property is an investment that can provide a steady stream of income and appreciate in value over time. However, it also comes with its own set of responsibilities and financial considerations.

Think of it as starting a small business—one where your product is a home for someone else. Success requires careful planning, a clear understanding of the market, and a solid financial strategy. Let’s break down what that really means.

Defining a Buy to Let Property

A buy to let property is simply a residential property you purchase with the specific intention of renting it out to tenants, rather than living in it yourself. It’s an investment designed to generate rental income and, hopefully, capital growth over the long term. Unlike flipping a house, where the goal is a quick profit from a sale, buy to let is typically a longer-term strategy. You become a landlord, providing housing in exchange for regular rent payments. This approach is a cornerstone of many investment portfolios, offering a tangible asset that you can see and manage.

The Benefits of Investing in Buy to Let

One of the biggest draws of buy to let is the potential for consistent monthly income. But the financial perks don’t stop there. As a landlord, you can often claim tax deductions on many of your expenses, including mortgage interest, insurance, and maintenance costs. Over time, the property itself may increase in value, building your equity. While owning a rental property can be incredibly rewarding, it’s not a get-rich-quick scheme. It requires thoughtful planning and management to ensure it’s a profitable venture. With the right property and a solid strategy, it can be a powerful way to build long-term wealth.

Your Core Responsibilities as a Landlord

Becoming a landlord is a significant commitment. You’re responsible for the property’s upkeep and your tenants’ safety and well-being. This means you’ll need to handle repairs promptly, whether it’s a leaky faucet or a major appliance failure. If you’re not comfortable doing the work yourself, you’ll need to hire trusted professionals. You’ll also be in charge of finding and screening tenants, collecting rent, and handling any issues that arise. Being a landlord requires you to be firm and professional, even in difficult situations. For many investors, especially those overseas or with busy schedules, partnering with a property management company to handle these day-to-day tasks is the key to a stress-free experience.

How to Find the Right Buy to Let Property

Finding the perfect investment property isn’t about luck; it’s about having a clear strategy. The right property for you will align with your financial goals, your desired level of involvement, and the type of tenants you want to attract. By breaking down the search into a few key areas, you can move forward with confidence and clarity. Let’s look at the essential factors to consider so you can pinpoint an investment that truly works for you.

Explore Different Property Types

The first step is to think about what kind of property best suits your investment plan. You can find a range of options, from modern apartments and traditional terraced houses to larger, multi-unit buildings. Each comes with its own set of responsibilities and potential returns. For a more hands-off approach, you might consider an off-plan property. These are new builds purchased before they are completed, meaning they come with brand-new fixtures and fittings, require minimal initial maintenance, and are often highly desirable to tenants. Your choice will depend on your budget, target tenants, and how actively you want to manage your investment.

Analyze Potential Locations

The old saying “location, location, location” is a cliché for a reason—it’s absolutely critical for a successful buy to let investment. Look for areas with strong rental demand and potential for growth. Key indicators include excellent transport links, proximity to major employment hubs, good schools, and local amenities like shops and parks. Researching areas undergoing regeneration can also be a smart move, as this often leads to an increase in property values and rental rates over time. A great location not only attracts quality tenants quickly but also helps secure the long-term value of your asset.

Assess the Property’s Condition

A property’s condition directly impacts your initial outlay and ongoing costs. An older property might be cheaper to buy but could come with hidden expenses for renovations, like updating the electrical systems or replacing the boiler. On the other hand, a fully renovated or new-build property is ready for tenants immediately, saving you time and stress. This turnkey solution is ideal if you’re looking for a more hands-off investment experience. Always factor in the potential for repairs and maintenance when you’re comparing different properties to get a true sense of the total investment required.

Identify Your Ideal Tenants

Before you even start looking at listings, picture your ideal tenant. Are you aiming to rent to students, young professionals, families, or tourists on short-term lets? Your answer will guide your entire search. For example, if you want to attract students, a property near a university with multiple bedrooms makes sense. To appeal to young professionals, a stylish one or two-bedroom apartment in the city centre with great transport links would be perfect. Understanding your target tenant demographic helps you choose the right property in the right location, ensuring it stays occupied and profitable.

Get to Grips with the Finances

Finding the perfect property is only half the story; making sure the numbers add up is what turns a good property into a great investment. A solid financial plan is your foundation for long-term success in the buy-to-let market. It helps you anticipate costs, secure funding, and accurately project your returns. Let’s walk through the key financial steps you need to take before making an offer.

Calculate Your Initial Costs

One of the most common mistakes new investors make is focusing only on the property’s purchase price. The total upfront investment is always higher. You need to budget for a range of additional expenses, including Stamp Duty Land Tax (which has a surcharge for second homes), solicitor fees, and mortgage arrangement fees. It’s also wise to set aside funds for an independent property survey and any immediate repairs or refurbishments needed to make the property ready for tenants. Creating a simple spreadsheet to list these expenses will give you a clear picture of the total capital you’ll need from the start.

Understand Your Mortgage Options

A mortgage for a rental property is different from the one you have on your own home. Buy-to-let mortgages typically require a larger deposit, usually around 25% of the property’s value, and often come with slightly higher interest rates. Lenders will also assess your application differently, focusing on the property’s potential rental income to ensure it covers the mortgage payments by a certain margin. It’s a great idea to speak with a mortgage advisor who specialises in buy-to-let products. They can help you find the most suitable and competitive mortgage deals for your situation.

Key Financial Metrics to Track

To gauge the health of your investment, you’ll need to get comfortable with a few key numbers. The most important are rental yield, cash flow, and return on investment (ROI). Rental yield shows your annual rental income as a percentage of the property’s value, giving you a quick comparison tool. Cash flow is the money left over each month after you’ve paid the mortgage and all other expenses. Positive cash flow is your goal. Finally, ROI measures the total return on your invested cash. Using tech tools for investors can help you analyze these metrics and manage your property for the best possible returns.

Prepare for Tax Obligations

As a landlord, the income you receive from rent is taxable. However, you can also deduct many of your running costs to reduce your tax bill. These allowable expenses often include mortgage interest, insurance premiums, maintenance and repair costs, and letting agent fees. It’s also important to be aware of Capital Gains Tax, which you may have to pay if you sell the property for a profit in the future. Tax rules can be complex and change over time, so getting professional advice is essential to ensure you are compliant and efficient. You can find official guidance on the government’s website about paying tax on rental income.

Secure the Right Insurance

Your standard home insurance policy won’t cover a rental property. You need specialist landlord insurance. Owning a rental property comes with unique risks and responsibilities, and the right insurance is your safety net. A good policy will cover you for building damage, but it can also include public liability in case a tenant or visitor is injured at your property. Many policies also offer coverage for loss of rent if the property becomes uninhabitable after an insured event, like a fire or flood. This protection is crucial for maintaining your income stream and peace of mind.

Uncover Potential Hidden Costs

Beyond the initial purchase and monthly mortgage, there are other ongoing costs to factor into your budget. You’ll need a contingency fund for unexpected repairs and maintenance. It’s also important to plan for void periods—times when the property might be empty between tenancies. If your property is a flat, you’ll likely have annual service charges and ground rent to pay. Many landlords also choose to hire a property management company for a hands-off experience. While this service comes at a cost, it can save you significant time and stress, making it a planned expense rather than a hidden one.

Where to Look for Buy to Let Properties

Once you have a clear idea of the type of property you want, the next question is where to find it. Your search can take you down several paths, from browsing online listings on your lunch break to partnering with specialists who can grant you access to exclusive opportunities. Each route has its advantages, and the best approach often involves using a combination of these resources. Let’s walk through the most effective places to find your next buy-to-let investment.

Work with a Property Investment Company

If you want expert guidance and access to off-market deals, working with a property investment company is an excellent choice. These firms specialize in sourcing properties that fit specific investment criteria, saving you time and effort. Companies like Portico Invest offer a fully hands-off service, which is perfect for both new and overseas investors who need a trusted team on the ground. While other large firms like Savills and Knight Frank also operate in this space, a dedicated investment partner can provide a more personalized experience. They handle the due diligence and negotiations, helping you avoid common mistakes that real estate investors should avoid and ensuring your purchase is a sound one from the start.

Explore Property Auctions

For investors who are comfortable with a fast-paced environment and have their finances in order, property auctions can be a fantastic place to find a bargain. Properties are often listed at auctions because they require a quick sale, which can translate into a lower purchase price for you. However, this route requires serious preparation. You’ll need to view the property, have a solicitor review the legal pack, and have your deposit and financing ready to go on auction day. It’s a high-stakes environment, but the potential to secure a property below market value makes it an exciting option for seasoned investors and well-prepared newcomers.

Partner with Estate Agents

Building relationships with local estate agents in your target area is a classic strategy that still pays dividends. A good agent has deep knowledge of the local market and is often the first to know about properties before they’re listed online. By making it clear that you are a serious, purchase-ready investor, you can get on their shortlist for off-market opportunities. Let them know your exact criteria and check in regularly to stay top of mind. An experienced agent can be an invaluable ally, offering insights into the best streets for rental demand and helping you negotiate a better deal when you find the right property.

Search on Online Property Portals

Online property portals are the most accessible starting point for any investor. Websites like Rightmove and Zoopla have thousands of listings that you can filter to match your specific needs, from property type and price to keywords like “tenant in situ.” Set up instant alerts for your saved searches so you’re notified the moment a matching property hits the market. While you’ll face more competition on these public sites, they are an indispensable tool for understanding market prices and identifying potential opportunities. These portals are the first step; the next is using other websites to analyze investment property to ensure the numbers stack up.

Build Your Investment Strategy

Jumping into the property market without a clear plan is like setting off on a road trip without a map. You might get somewhere eventually, but it probably won’t be your ideal destination. A solid investment strategy is your roadmap to success, guiding every decision you make, from the type of property you buy to the location you choose. It’s about moving beyond guesswork and making informed choices that align with your financial goals. This is where the real work begins, but it’s also where the foundation for a profitable portfolio is laid.

Think of your strategy as your personal investment policy. It will help you stay focused and avoid making emotional decisions when you find a property you love but that doesn’t quite fit your criteria. It forces you to look at the numbers, understand the market, and plan for the future. A well-researched strategy considers market trends, rental demand, and long-term growth potential. It also prepares you for the inevitable risks and responsibilities of being a landlord. Taking the time to build this framework now will save you countless headaches and financial missteps down the line, ensuring your journey into property investment is as smooth and successful as possible.

Research Current Market Trends

Before you even think about viewing properties, you need to get a feel for the current market climate. Are prices rising or falling? How quickly are homes selling? Understanding these dynamics will help you spot opportunities and avoid overpaying. You can get a great overview by checking the official UK House Price Index, which provides a reliable snapshot of the market. Spend some time on property portals, too, looking at what homes are selling for in your target areas. This initial research helps you set realistic expectations and approach your search with confidence, knowing what a fair price looks like.

Analyze Local Rental Demand

A beautiful property is a poor investment if no one wants to rent it. That’s why analyzing local rental demand is a non-negotiable step. You need to know who your potential tenants are and what they’re looking for. Are young professionals seeking one-bedroom flats near transport links, or are families looking for three-bedroom houses near good schools? Check out rental listings in your target postcodes to see what’s available and how much it costs. Strong demand often means fewer void periods and a more stable income for you. Resources like Rightmove’s rental trends tracker can give you valuable data on what’s happening in the rental market right now.

Pinpoint High-Growth Areas

The goal of any investment is to see it grow, and property is no different. Investing in an area with strong growth potential can significantly increase your return over time. Look for locations undergoing regeneration, with new businesses moving in, and infrastructure projects planned. These are all signs that an area is on the upswing, which can lead to both higher rental income and capital appreciation. Cities like Liverpool, for example, have seen massive investment and regeneration, making them attractive places for buy-to-let investors. Identifying these UK property hotspots early is key to maximizing your long-term financial outcomes.

Choose Your Investment Horizon

Property investment is typically a marathon, not a sprint. It’s important to be realistic about your timeline and what you want to achieve. Are you looking for immediate monthly cash flow to supplement your income, or are you focused on long-term capital growth for your retirement? Your answer will shape your entire strategy. If cash flow is your priority, you’ll focus on properties with high rental yields. If capital growth is the goal, you’ll look for properties in up-and-coming areas. Defining your investment goals from the start helps you stay patient and focused on the bigger picture, as it can take several years to build substantial equity and profit.

Assess and Manage Investment Risks

Every investment carries some level of risk, and it’s smart to go in with your eyes wide open. As a landlord, you’ll face potential challenges like unexpected repairs, periods when your property is empty, or tenants who don’t pay on time. The best way to manage these risks is to plan for them. Always budget for higher expenses and lower income than you initially project. This means setting aside a healthy contingency fund for maintenance and potential void periods. Understanding your legal landlord responsibilities is also crucial for protecting yourself and your tenants. Being prepared doesn’t mean being pessimistic; it means being a savvy and resilient investor.

Stay Compliant: Legal and Safety Standards

Being a landlord comes with a set of rules that aren’t just suggestions—they’re legal requirements. Getting your head around the legal and safety standards from the start protects you, your tenants, and your investment. It might seem like a lot to track, but breaking it down makes it manageable. Think of it as the foundation of a successful and stress-free rental business. When you know you’ve got everything covered, you can focus on the more rewarding parts of being a property investor. Let’s walk through the key areas you need to master to stay compliant and keep everyone safe.

Follow Key Safety Regulations

Your tenant’s safety is your top priority, and the law agrees. You are legally required to ensure your property meets specific standards. This includes arranging an annual gas safety check by a Gas Safe registered engineer and providing your tenants with a copy of the certificate. You also need to make sure all electrical systems and appliances you provide are safe, which typically involves an electrical safety inspection every five years. Fire safety is another critical area, so you must install smoke alarms on every floor and carbon monoxide alarms in any room with a solid fuel-burning appliance. These aren’t just boxes to tick; they are fundamental duties that protect lives.

Understand Tenant Rights

Your tenants have rights that are protected by law, and it’s your job to know them inside and out. This goes beyond just providing a roof over their head. You must ensure the property is a safe and habitable place to live throughout their tenancy. This includes handling their security deposit correctly by placing it in a government-approved protection scheme. You also need to follow the proper legal procedures if you ever need to end a tenancy. Familiarizing yourself with the government’s “How to Rent” guide is a great first step. Respecting tenant rights builds trust and is the cornerstone of a positive landlord-tenant relationship.

Get the Necessary Certifications

Before you can even think about renting out your property, you need the right paperwork in place. One of the most important documents is the Energy Performance Certificate (EPC), which rates your property’s energy efficiency. Your property must meet a minimum EPC rating (currently ‘E’ in England and Wales) to be legally let. You must also give a copy of the EPC to your tenants. Depending on your property’s location, you might also need a landlord license from your local council. These regulations can change, so always check what’s required in your specific area to avoid fines and legal headaches.

Confirm Your Insurance Coverage

Your standard home insurance policy won’t cover a rental property, so you’ll need specialized landlord insurance. This is crucial for protecting your investment from the unexpected. A good policy should include property damage, covering the building’s structure from events like fires or floods. It should also provide liability protection in case a tenant or visitor is injured at your property. Many landlords also opt for rent guarantee insurance, which covers you if your tenants fail to pay rent. Having the right landlord insurance coverage gives you peace of mind that your financial future is secure, no matter what happens.

Use a Landlord Compliance Checklist

With so many responsibilities to juggle, it’s easy for something to slip through the cracks. This is where a landlord compliance checklist becomes your best friend. It’s a simple tool to help you track all your legal obligations, from safety checks and certifications to deposit protection and right-to-rent checks. You can create your own or find a template online. Using a landlord compliance checklist ensures you’ve covered all your bases before your tenants move in and helps you keep track of renewal dates for important documents. It’s a straightforward way to stay organized and demonstrate your professionalism as a landlord.

Manage Your Property Effectively

Once you’ve finalized the purchase, your journey as a landlord truly begins. Effective property management is the key to turning a great property into a successful, profitable investment over the long term. It’s about more than just collecting rent; it involves maintaining the property, keeping your tenants happy, and handling the finances with a sharp eye. Poor management can quickly erode your returns, while a thoughtful approach protects your asset and ensures a steady income stream.

The first major decision you’ll face is whether to manage the property yourself or hire a professional. Owning a rental property comes with significant risks and responsibilities, and your capacity to handle them will shape your experience as a landlord. If you live far from your investment property or simply don’t have the time for day-to-day tasks, a management company can be a lifesaver. On the other hand, if you live nearby and have the skills and time, self-management can be a rewarding way to maximize your profits. Whatever path you choose, having a clear plan for every aspect of management—from finding tenants to fixing leaks—is essential.

Decide Between Professional and Self-Management

Choosing how to manage your property is one of the most critical decisions you’ll make. If you decide to self-manage, you’ll be responsible for everything from marketing the property and screening tenants to handling repairs and collecting rent. This hands-on approach allows you to keep all the rental income after expenses, but it requires a significant commitment of time and effort. For investors who are local and enjoy being actively involved, this can be a great option.

Alternatively, you can hire a professional property management company. This is an ideal solution for overseas investors or anyone who wants a more hands-off investment. A good management company handles all landlord duties for you, providing a completely turnkey service. While their fees will reduce your overall profit, the peace of mind and freedom they provide are often well worth the cost. At Portico Invest, we offer comprehensive management solutions to make your investment experience as smooth and stress-free as possible.

Create a Tenant Screening Process

The quality of your tenants can make or break your buy-to-let investment. Problematic tenants can lead to late payments, property damage, and costly eviction processes. That’s why a thorough tenant screening process is non-negotiable. Don’t rush this step, even if you’re eager to fill a vacancy. Taking the time to choose your renters wisely is one of the best ways to avoid future headaches.

Your screening process should include a few key checks. Start with a detailed application form, followed by credit and background checks to assess their financial reliability. Always ask for references from previous landlords and current employers to verify their rental history and income. This diligence helps you find responsible individuals who will pay rent on time and take good care of your property, ensuring a stable and positive landlord experience.

Plan for Ongoing Maintenance

Every property requires regular upkeep and will eventually need repairs. Factoring these costs into your budget from day one is crucial for maintaining profitability. You’ll need to cover everything from small fixes, like a dripping tap, to major replacements, such as a new boiler. If you aren’t able to do the work yourself, you’ll also need to budget for hiring professionals.

A good rule of thumb is to set aside 1% of the property’s value annually for maintenance costs. For example, for a £200,000 property, you would budget £2,000 per year. Another common method is to save 10% of your monthly rental income in a separate account specifically for repairs. This proactive approach ensures you have funds available when you need them, preventing small issues from turning into expensive problems and keeping your property in excellent condition for your tenants.

How to Handle Void Periods

Void periods—the times when your property is unoccupied between tenancies—are an inevitable part of being a landlord. During these times, you won’t be receiving rental income, but you’ll still have to cover expenses like mortgage payments, insurance, and council tax. It’s essential to be realistic about your income and factor these potential gaps into your financial calculations to get a true picture of your investment’s performance.

To minimize void periods, start marketing your property as soon as your current tenant gives notice. High-quality photos and a compelling description can attract new applicants quickly. Keeping the property well-maintained also makes it more appealing and can reduce the turnaround time between tenants. A proactive strategy helps keep your rental income consistent and your investment on track. For more ideas, you can find great tips on reducing void periods from landlord associations.

Build a Network of Trusted Contractors

When a pipe bursts or the heating fails, you need to act fast. For self-managing landlords, having a list of reliable and vetted contractors is essential. Don’t wait for an emergency to start searching for a plumber, electrician, or handyman. Build your network ahead of time by asking for recommendations from other local landlords or using trusted platforms to find qualified professionals.

Having a go-to team ensures you can handle repairs quickly and efficiently, which keeps your tenants happy and protects your property from further damage. This is another area where a property management company adds significant value. A professional manager already has an established network of trusted contractors, saving you the time and stress of finding someone reliable in a pinch. This built-in support system is one of the key benefits of a fully managed service.

Your Step-by-Step Purchase Plan

With your strategy in place, it’s time to move toward the purchase itself. Breaking the process down into clear, manageable steps makes it feel much less intimidating. Think of this as your personal roadmap from initial research to finally getting the keys. Following a structured plan helps you stay organized, make informed decisions, and avoid common pitfalls that can trip up new investors. Let’s walk through the six key steps to successfully purchasing your buy to let property.

Step 1: Research and Plan

Before you even start looking at listings, the very first thing to do is make a plan. Buying a property without knowing how it fits into your financial goals is a recipe for stress. Your plan should outline what you want to achieve—are you looking for immediate rental income, long-term capital growth, or a mix of both? Decide how you will manage the property. Will you be a hands-on landlord, or would a fully managed service suit your lifestyle better? Creating this blueprint is essential for avoiding common real estate mistakes and ensures every decision you make aligns with your end goal.

Step 2: Prepare Your Finances

Your financial standing is the foundation of your investment journey. Lenders will look closely at your financial health, so it’s important to get everything in order early on. Start by checking your credit report and taking steps to improve your score if needed, as underestimating the importance of your credit score is a frequent pitfall for new investors. You’ll also need to calculate how much you can afford for a deposit and other upfront costs. Getting a mortgage in principle at this stage can give you a clear budget and show sellers and agents that you’re a serious buyer, putting you in a much stronger position.

Step 3: Define Your Property Criteria

Once your finances are sorted, you can define exactly what you’re looking for in a property. Create a checklist of your ideal investment criteria: location, property type (e.g., flat, terraced house), number of bedrooms, and target tenant demographic. Having clear criteria helps you focus your search and quickly filter out unsuitable options. It’s also wise to look at and research multiple properties that fit your general criteria. This gives you a solid understanding of what’s available in your target market and what constitutes a fair price, preventing you from making a hasty decision on the first property you see.

Step 4: Conduct Due Diligence

You’ve found a property that ticks all the boxes—now it’s time to do your homework. This is the due diligence phase, and it’s one of the most critical steps. Overlooking the importance of thorough due diligence can lead to expensive problems down the line. This involves arranging a professional survey to check for structural issues, having your solicitor review all legal documents, and independently verifying the local rental demand and potential yield. Don’t just take the seller’s or agent’s word for it. This is your opportunity to uncover any hidden issues and ensure the investment is as solid as it appears on paper.

Step 5: Finalize the Purchase

With your due diligence complete and your confidence in the property secured, you can move forward with finalizing the purchase. This begins with making a formal offer. If it’s accepted, you’ll work with your solicitor and mortgage lender to complete the transaction. This stage involves a lot of paperwork and coordination, so responsive communication with your team is key. It’s also important to remain disciplined with your budget. A key risk for new investors is borrowing too much and becoming overleveraged. Stick to the financial plan you created in step one to ensure your investment remains profitable and sustainable.

Step 6: Set Up Your Investment for Success

Congratulations, you’re a property owner! The final step is to set up your investment for long-term success. This involves arranging landlord insurance, setting up a system for rent collection, and deciding on your property management approach. If you’re self-managing, you’ll need to find and screen tenants. If you prefer a hands-off approach, now is the time to partner with a management company. There are many helpful tech tools available to help you analyze your investment’s performance and manage finances. Getting these systems in place from day one will make your life as a landlord much easier and help you maximize your returns.

Related Articles

- UK Buy-to-Let Property Investment: Your Essential Guide | Portico Invest

- Your Complete Guide to Buy-to-Let Investing | Portico Invest

- Buy-to-Let Investing: A Practical Beginner’s Guide | Portico Invest

- How to Build a Buy-to-Let Property Portfolio in 2024: Your Ultimate Guide

Frequently Asked Questions

Is an off-plan property a good choice for a first-time investor? For many first-time investors, an off-plan property can be an excellent starting point. Because you’re buying a new build, it arrives in perfect condition, which means you won’t have to worry about immediate repairs or renovations. This can save you a lot of time, stress, and upfront costs. It also means the property is often more attractive to tenants who are looking for modern amenities, helping you find renters more quickly.

How much money do I actually need to get started, beyond the deposit? It’s a common mistake to only budget for the deposit, but there are several other costs to plan for. You’ll need to cover solicitor fees for the legal work, mortgage arrangement fees, and a potential surcharge on your Stamp Duty for owning a second property. It’s also smart to have a separate fund set aside for furnishing the property if it’s unfurnished and for any initial landlord insurance policies. Thinking about these costs from the beginning gives you a true picture of your total initial investment.

What’s the real difference between managing a property myself and hiring a company? The main difference comes down to a trade-off between your time and your money. Managing the property yourself means you are the point of contact for everything—finding tenants, collecting rent, and arranging emergency repairs at all hours. While you save on management fees, it requires a significant time commitment. Hiring a management company means you pay a fee, but they handle all of those responsibilities for you. This is often the preferred route for investors who live far away or want a more hands-off experience.

How can I tell if an area has strong potential for growth? Look for clear signs of investment and development in the area. Are there new transport links being built, like a new train station or improved bus routes? Are new businesses, cafes, and shops opening up? These are indicators that the area is becoming more desirable. Regeneration projects and significant investment from local councils are also strong signals that property values and rental demand are likely to increase over time.

What is “rental yield” and why does it matter so much? Rental yield is a simple calculation that helps you quickly compare the potential return of different properties. It shows you the annual rental income you can expect as a percentage of the property’s total cost. A higher yield generally indicates a better return on your investment. It’s a crucial metric because it helps you look past the purchase price and focus on how hard the property will actually work for you financially each year.