You’ve heard the saying a thousand times: location, location, location. In property investment, it’s more than a cliché—it’s the golden rule. The right location is the single most important factor in securing a profitable buy-to-let. While a “good” return can vary based on your personal goals, some areas consistently outperform others, offering a powerful combination of high rental yields and strong potential for property value growth. The key is to look beyond the obvious hotspots and identify places with solid fundamentals. This guide explores where to find the best buy to let returns UK wide, from bustling northern cities to regenerating London boroughs, giving you a clear idea of where you might find your next great investment.

Key Takeaways

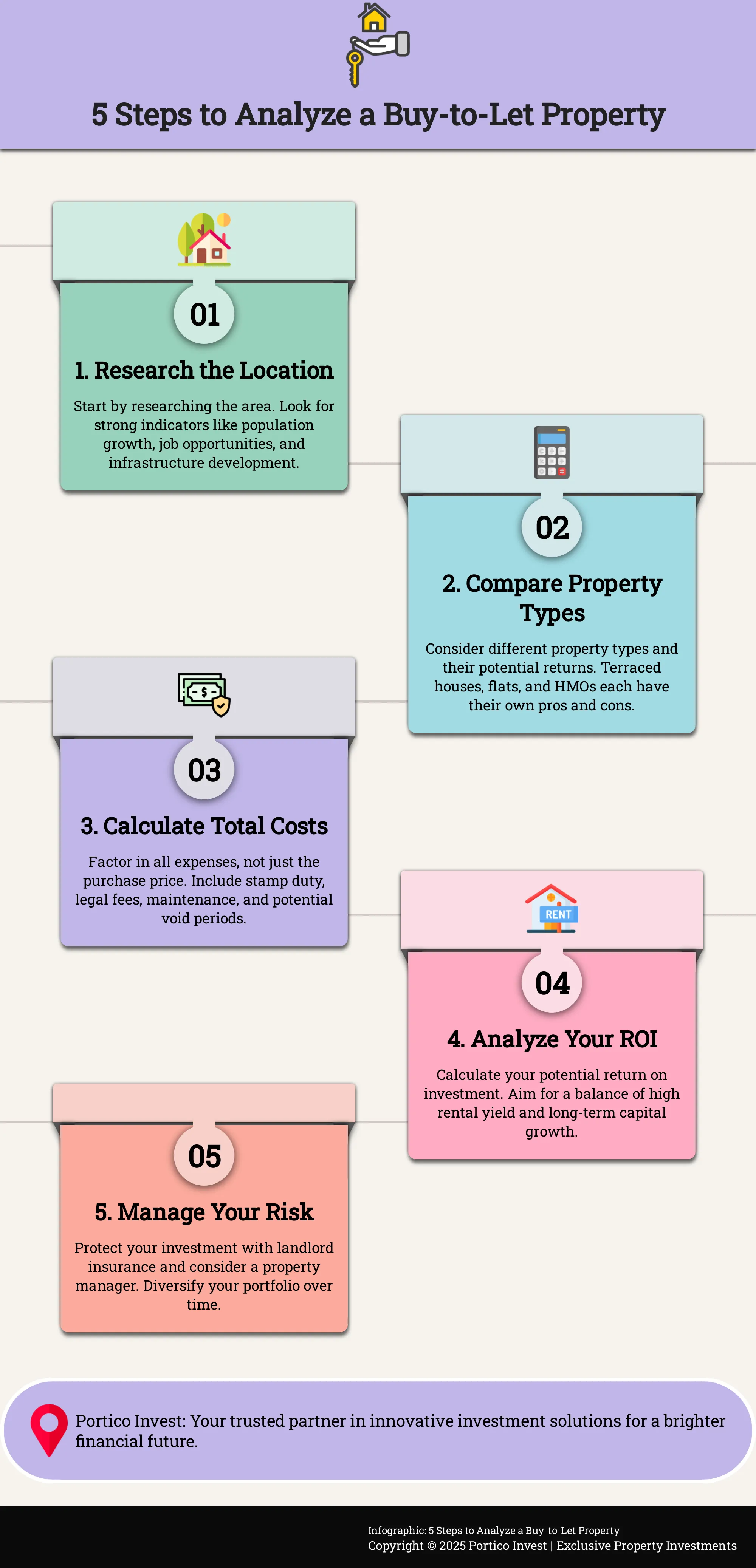

- Master the Math Before You Invest: A successful buy-to-let is built on solid numbers, not just a gut feeling. Calculate your potential rental yield and total return on investment, making sure to account for every cost—from stamp duty and legal fees to ongoing maintenance and potential void periods.

- Location Dictates Long-Term Success: The right property in the wrong place is a poor investment. Prioritize research into areas with strong fundamentals like population growth, employment opportunities, and infrastructure development to ensure steady tenant demand and future capital growth.

- Protect Your Asset Proactively: Being a landlord is an active role that requires smart management. Safeguard your investment with specialized landlord insurance, consider a professional property manager for day-to-day tasks, and stay on top of maintenance to keep your property in great shape and your tenants happy.

What Is a Good Buy-to-Let Return?

When you start looking at buy-to-let properties, one of the first questions you’ll ask is, “What makes a good investment?” The answer usually comes down to the return. Your return on investment (ROI) is the measure of how hard your money is working for you. But it’s not just one simple number; it’s a combination of the monthly rental income you collect and the long-term value appreciation of the property itself.

Understanding what a strong return looks like and how to calculate it is the first step toward building a successful property portfolio. It helps you compare different opportunities and spot the ones with the most potential. Let’s break down what you need to know to evaluate a property’s financial performance.

Defining a Strong Return

So, what’s the magic number you should be looking for? Generally, a good rental yield for a buy-to-let property falls somewhere between 5% and 10%. While some experienced investors might aim for 12% or higher in specific high-growth areas, this range is a solid benchmark for a healthy investment. What’s considered “good” can also depend on your personal investment goals. For example, a property in a prime city-centre location might have a slightly lower rental yield but offer incredible potential for long-term value increase. The key is to find a balance that aligns with your financial strategy.

How to Calculate Rental Yield

Don’t worry, the maths here is straightforward. Rental yield is a quick and easy way to compare the potential returns of different properties. It shows you the annual rental income as a percentage of the property’s value.

Here’s the simple formula: (Annual Rental Income / Property Purchase Price) x 100 = Rental Yield %

For example, if you buy a property for £100,000 and the monthly rent is £500, your annual rental income is £6,000 (£500 x 12). The calculation would be: (£6,000 / £100,000) x 100 = 6%

This gives you the gross rental yield, a great starting point for assessing an opportunity before you factor in other costs like maintenance or management fees.

Capital Growth vs. Rental Income

A successful buy-to-let investment works for you in two ways: through monthly rental income and long-term capital growth. Think of rental income as your short-term cash flow—the money that covers your mortgage and expenses while putting a bit extra in your pocket each month. Capital growth, on the other hand, is the long-term prize. It’s the increase in your property’s value over time, building your wealth quietly in the background. The most profitable property investments are those that deliver a healthy mix of both: consistent rental income to keep you profitable today and strong capital growth to secure your financial future.

Find the Best Locations with These Tools

Finding the perfect buy-to-let location isn’t about luck; it’s about smart research. Before you even think about viewing a property, you need to become an expert on the area. The good news is, you don’t have to do it alone. There are some fantastic, readily available tools that can give you a clear picture of a location’s potential. Using these resources helps you move past gut feelings and make decisions based on solid data. Think of it as your pre-investment homework—doing it right will save you time, money, and stress down the line.

A successful investment is built on a foundation of knowledge. This means understanding the nuances of the local rental market, from what tenants are willing to pay to which postcodes are seeing the most interest. It also means looking beyond the present and into the future. What new developments are planned? Are major employers moving in? These are the factors that drive long-term capital growth and ensure a steady stream of quality tenants. It’s easy to get swept up in the excitement of a potential property, but the real value is created long before you make an offer. By digging into the data, you can spot opportunities that others might miss and avoid areas that look good on the surface but lack long-term potential. Let’s walk through the best places to start your search so you can invest with confidence.

Property Data Platforms

Your first stop should be the major property portals. Websites like Rightmove and Zoopla are more than just listing sites; they are treasure troves of market data. You can see what properties are currently available for rent, check the average rental prices for different property types (like a two-bed flat versus a three-bed house), and see how long properties tend to stay on the market. This gives you a real-time snapshot of rental demand. Spend some time exploring the areas you’re interested in to get a baseline understanding of what tenants are looking for and what you can realistically charge. This initial research is fundamental for building an accurate financial forecast for any potential investment.

Market Research Resources

Once you have a feel for the current market, it’s time to look at the historical data. For official and reliable information, the HM Land Registry is an invaluable resource. It provides actual sold prices, which helps you understand how property values have trended over time. This is crucial for assessing capital growth potential, which is just as important as rental yield. Looking at this data helps you see if an area is on an upward trajectory or if prices have stagnated. This historical context gives you a more complete picture of your potential return on investment and helps you avoid buying at the peak of a short-lived boom.

Government Data Sources

To get a glimpse into the future of an area, your local council’s website is the place to go. Local authorities are required to publish information on planning applications and new development projects. Are there plans for a new shopping centre, a major office block, or a large residential development? These are strong indicators of future growth, job creation, and increased housing demand. A quick search on the local council’s planning portal can reveal projects that will make an area more attractive to renters in the coming years. This forward-looking research can give you a significant edge, allowing you to invest in an area just before it takes off.

Local Economic Indicators

Data is great, but you also need to understand the story behind the numbers. Strong local economic indicators are what drive a thriving rental market. Look for news about new companies or major employers moving into the area, as this brings jobs and people looking for a place to live. Pay attention to infrastructure improvements, like new transport links or regeneration projects that enhance local amenities. These developments don’t just make an area a better place to live; they directly support property value appreciation and create a steady stream of potential tenants for your investment. A growing local economy is one of the surest signs of a healthy and sustainable buy-to-let market.

Top UK Locations for High Returns

Finding the right location is the cornerstone of a successful buy-to-let investment. While a “good” return can vary based on your personal goals, some areas consistently outperform others, offering a powerful combination of high rental yields and potential for property value growth. The key is to look beyond the obvious hotspots and identify places with strong fundamentals, like a growing population and a thriving local economy.

From the bustling cities of the North to regenerating London boroughs, opportunities are everywhere if you know where to look. We’ll explore four types of locations that are currently delivering impressive returns for investors, giving you a clear idea of where you might find your next property.

Northern Powerhouse Cities

For investors chasing high rental yields, Northern England is a fantastic place to start. Cities across the North offer some of the most attractive returns in the country, largely because property prices are more affordable, while rental demand remains strong. Take Bradford (BD1), for example, which can see yields reach an incredible 12.0%. Similarly, areas in Sunderland (SR1) and Leeds (LS3) offer yields well above 8.5%, with some properties available for under £70,000. This blend of low entry costs and high rental income is what makes the Northern Powerhouse region so appealing for building a profitable portfolio.

University Towns

Investing in university towns is a classic strategy for a reason: it works. Areas with large student populations provide a consistent and reliable stream of tenants year after year. Cities like Leeds (LS3), with its proximity to major universities, can generate yields of 10.6%. Nottingham (NG1) is another prime example, where a bustling city centre and strong demand for quality rental homes result in yields around 8.7%. This steady demand from students, lecturers, and university staff helps minimize void periods and provides a stable foundation for your investment, making student property a dependable choice for many landlords.

Up-and-Coming Areas

Some of the best investment opportunities are found in areas on the brink of transformation. These are places with significant regeneration projects, business growth, and new transport links in the pipeline. Identifying these indicators can help you invest before property prices catch up to the area’s potential. Look for signs of local investment, like new housing developments or commercial hubs being built. The government’s focus on levelling up means many towns and cities are receiving funding for these kinds of improvements, creating exciting prospects for investors who can spot the potential early on.

London Boroughs to Watch

While Central London is known for its sky-high property prices, certain outer boroughs offer a much more accessible entry point with promising returns. Regeneration is turning these areas into vibrant communities with excellent transport links and more affordable housing. For instance, Purfleet (RM19) is benefiting from major improvements and offers yields of 7.4%. Barking (IG11) and Dagenham (RM10) are also undergoing significant transformations, with new housing and great connections to the city centre, delivering yields of around 6.7%. These boroughs prove that you can still find valuable investment opportunities within the capital.

What Drives Strong Rental Yields?

So, what’s the secret to a high-yield rental property? It’s not just about the building itself—it’s all about the location. Certain key factors can turn a good investment into a great one by creating consistent demand from tenants. When you’re scouting for your next buy-to-let, keeping an eye on these five drivers will help you spot areas with the most potential for strong, steady returns. Think of it as a checklist for finding a location that works as hard as you do. A city with a growing population, strong job prospects, and ongoing development is a city where people want to live, and that’s exactly where you want to invest.

Population Growth

A growing population is a fantastic sign for a landlord. More people moving into an area means more people looking for a place to live, which keeps demand for rentals high. Areas with universities or large employers, like hospitals, are often buy-to-let hotspots. They attract a steady stream of students and professionals who need housing, creating a reliable pool of potential tenants for your property. This consistent demand helps reduce the risk of long vacant periods and supports stable rental income year after year.

Employment Opportunities

A thriving job market is another key ingredient for a successful rental investment. When a city has major employers or is close to universities, it acts like a magnet for workers and students. This constant influx of people creates a stable demand for rental homes. As a landlord, focusing on these larger towns and cities means you’re tapping into a consistent need for housing, which helps keep your property occupied and your rental income flowing. A strong local economy provides tenants with the financial stability to pay rent on time, making your investment more secure.

Infrastructure Development

Keep an eye out for cranes in the sky and regeneration projects on the ground. These are signs of infrastructure development that can make an area much more appealing to renters. New shopping centres, improved public spaces, and updated facilities all contribute to a better quality of life. Investing in an area that’s actively improving can lead to higher tenant demand and potentially increase your property’s value over time. It shows that the local council and private companies are confident in the area’s future, which is a great signal for investors.

Transport Links

Easy commutes are a huge selling point for tenants. Properties with great transport links—like nearby train stations or frequent bus routes—are always in high demand. When a city invests in improving its public transport, it makes it easier for people to get to work and explore the area. This convenience can make your property stand out and attract a wider range of potential renters, from young professionals to families. Good connectivity doesn’t just add convenience; it adds value to your investment.

Local Amenities

Finally, don’t underestimate the power of great local amenities. People want to live in places that are convenient and enjoyable. Proximity to shops, parks, good schools, and cafes can make a huge difference in a property’s appeal. These features create a vibrant community and a higher quality of life, which are major draws for long-term tenants. When you’re researching a location, take a walk around the neighbourhood to see what it offers. A desirable lifestyle is one of the most valuable things you can offer a renter.

How to Analyze an Investment Opportunity

Once you’ve identified a promising city or neighbourhood, it’s time to look at specific properties. A great location is just the starting point; the property itself needs to have solid financial potential. Analyzing an opportunity isn’t about guesswork—it’s about running the numbers and doing your homework to make sure the investment aligns with your goals. This process helps you move forward with confidence, knowing you’ve made a decision based on data, not just a gut feeling.

Compare Property Types and Returns

Different types of properties offer different advantages. For example, terraced houses are a popular choice for landlords in many top-performing areas. They often provide a great balance of affordability and rental demand, making them an excellent option if you’re a new landlord or want to build a portfolio of several properties. Flats, on the other hand, might offer higher yields in city centres but can come with service charges. It’s important to compare the potential income and running costs of various property types in your target area to see what makes the most financial sense for you.

Do Your Market Research

Before you commit, get to know the local market inside and out. Focus your search on larger towns and cities, especially those with universities or major employers, as they tend to have a consistent stream of potential tenants. Look for signs of growth and investment in the area. Are there new building projects, transport upgrades, or businesses moving in? These are strong indicators that the location is on an upward trend, which can be great for future property values. A quick search for your target city’s local development plans can give you a clear picture of what’s on the horizon.

Calculate Your Total Costs

Your initial purchase price is only one part of the equation. To get a true sense of your investment, you need to account for all associated expenses. These include one-off costs like Stamp Duty Land Tax and legal fees, as well as ongoing expenses like insurance, maintenance, letting agent fees, and potential void periods between tenants. Remember that many of these costs can be deducted to lower your taxable profit. Creating a detailed list of every potential expense will help you avoid surprises and ensure your investment remains profitable from day one. You can find a full list of allowable expenses on the government’s website.

Analyze Your Return on Investment

Ultimately, a good investment needs to deliver a solid return. Many investors aim for a Return on Investment (ROI) between 5% and 10%, but the right number depends on your personal financial goals. A successful buy-to-let strategy balances two key elements: high rental yields for consistent monthly income and strong capital growth potential for long-term profit. Don’t focus on one at the expense of the other. Calculating your potential return on investment will help you compare different properties and choose the one that offers the best combination of immediate cash flow and future value.

Avoid These Common Investment Mistakes

Getting into property investment is exciting, but it’s easy to get tripped up by a few common hurdles. The good news is that with a bit of foresight, you can sidestep these issues entirely. Think of it as learning from others’ experiences so your own investment journey is as smooth and profitable as possible. Let’s walk through the five biggest mistakes new investors make and how you can steer clear of them.

Skipping Location Research

It’s tempting to jump on the first property that looks good on paper, but location is everything in buy-to-let. The UK property market isn’t one-size-fits-all; rental yields can vary dramatically from one city to the next. For instance, many investors find that Northern England is a top spot for high rental yields, thanks to regeneration projects and growing demand. Don’t just look at the property itself—look at the neighbourhood. Is it near good transport links? Are there jobs and amenities nearby? A little extra time spent on location research now will pay off significantly down the line.

Underestimating Your Costs

Your purchase price is just the beginning. Many first-time investors create a budget but forget to include all the expenses that come with owning a rental property. These can include property management fees, routine maintenance, insurance, and potential void periods between tenants. It’s also smart to plan for unexpected repairs—things like a broken boiler or a leaky roof can pop up when you least expect them. A good rule of thumb is to add a 10% to 20% buffer to your estimated costs to ensure you’re financially prepared for anything.

Ignoring Legal Compliance

Being a landlord comes with a set of legal and financial responsibilities you can’t afford to ignore. First and foremost, you must pay tax on the money you make from your rental income. This includes Income Tax, and you may also be liable for National Insurance and Capital Gains Tax if you decide to sell the property later. Staying on top of your tax obligations and other legal requirements, like safety certificates, isn’t just good practice—it protects you from hefty fines and legal trouble. If you’re unsure, it’s always best to consult with a professional.

Choosing the Wrong Tenants

You can find a property in a fantastic, high-yield area, but that potential means nothing if you can’t secure reliable tenants. Problematic tenants can lead to late rent payments, property damage, and stressful eviction processes, all of which eat into your returns. That’s why a thorough screening process is so important. Taking the time to check references, run credit checks, and have a proper conversation with applicants helps you find responsible people who will treat your property with respect. A happy tenant is more likely to stay long-term, giving you a stable and consistent income.

Neglecting Property Maintenance

It’s easy to put off small repairs, but neglecting maintenance is a costly mistake. Minor issues can quickly turn into major, expensive problems that diminish your property’s value. Regular upkeep not only protects your investment but also keeps your tenants happy, reducing turnover. Plus, many of these expenses are considered allowable business costs. This means you can lower your taxable profit by deducting costs for general repairs and maintenance. Staying proactive with upkeep is a smart financial move that keeps your property in great shape and your tenants content.

How to Manage Your Investment Risk

Every investment comes with some level of risk, but the best investors know how to manage it. A successful buy-to-let strategy isn’t just about finding a great property; it’s about protecting it for the long term. By taking a few proactive steps, you can safeguard your asset, ensure a steady income, and gain peace of mind. Smart planning turns potential headaches into manageable tasks, allowing you to focus on growing your portfolio and enjoying the returns. Let’s walk through four key strategies to keep your investment secure.

Get the Right Insurance

One of the biggest mistakes a new landlord can make is assuming their standard home insurance policy is enough. It isn’t. You need specialized landlord insurance, which is designed to cover the specific risks that come with renting out a property. A good policy will protect you against property damage, cover your liability if a tenant is injured, and even reimburse you for lost rental income if the property becomes uninhabitable after an insured event like a fire or flood. Don’t cut corners here; the right coverage is a fundamental safety net for your investment.

Work with a Property Manager

Managing a rental property can feel like a full-time job, especially if you live far away or have other commitments. Engaging a professional property manager is one of the smartest ways to reduce your risk and free up your time. A good manager handles everything from tenant screening and rent collection to maintenance issues and legal compliance. They act as a buffer between you and your tenants, ensuring your property is well-maintained and compliant with all regulations. For overseas investors, a trusted property manager is essential for a truly hands-off and stress-free experience.

Keep an Eye on the Market

The property market is always changing, so staying informed is crucial for making smart decisions. Keep an eye on local market indicators that can impact your investment’s value and rental demand. Pay attention to things like major regeneration projects, local job growth, and new business openings in the area. Are there plans for new transport links that could make the location more attractive? Staying aware of these trends will help you anticipate market shifts and position your investment for continued growth, ensuring you know when to hold, sell, or reinvest.

Diversify Your Portfolio

You’ve probably heard the advice “don’t put all your eggs in one basket,” and it absolutely applies to property investment. To manage risk effectively, consider diversifying your portfolio over time. This doesn’t have to happen overnight, but it’s a great long-term goal. Diversification can mean investing in different types of properties, like a mix of apartments and houses, or buying in different locations. Spreading your investments across various areas or property types helps balance your portfolio, combining assets that offer high rental yields with those that have strong potential for capital growth.

How to Build a Successful Portfolio

Building a successful property portfolio is about more than just buying a house; it’s about making a series of smart, strategic decisions. From managing your property to planning your finances, each step plays a crucial role in your long-term success. Here’s how you can set yourself up for a strong start and sustained growth.

Find the Right Property Management

A great investment property can become a headache without the right management. A professional property manager handles everything from finding and vetting tenants to dealing with maintenance requests, making your investment truly hands-off. This is especially vital if you’re an overseas investor or simply don’t have the time for day-to-day landlord duties. They ensure your property is well-maintained and your tenants are happy, which leads to lower vacancy rates and consistent income. Think of them as the operational arm of your investment, protecting your asset and your peace of mind. A full turnkey service can make the entire process seamless from purchase to rental.

Plan for Tax Efficiency

Understanding your tax obligations is key to maximizing your returns. As a landlord, you’ll need to pay tax on your rental income, but you can also deduct certain allowable expenses to lower your taxable profit. These are costs incurred “wholly and exclusively” for your property business, such as letting agent fees, maintenance, and insurance. The first £1,000 of your rental income is also tax-free, which is a helpful allowance. It’s always a good idea to get familiar with the rules or speak with a tax advisor to ensure you’re operating as efficiently as possible. You can find detailed official guidance on the UK government website.

Create a Financial Plan

Before you invest, you need a clear financial plan. Start by defining what a good return looks like for you. Many investors aim for a Return on Investment (ROI) between 5% and 10%, but your personal goals might be different. To calculate your potential ROI, you’ll need to account for all your costs—not just the purchase price, but also stamp duty, legal fees, and any renovation work. Then, estimate your net profit by subtracting ongoing expenses like mortgage payments, insurance, and management fees from your expected rental income. This simple calculation helps you evaluate different opportunities and make sure the numbers work for your long-term strategy.

Build Your Support Network

Successful property investment is rarely a solo effort. It takes a team of dedicated professionals to get everything right. This “power team” can include a sourcing agent to find great deals, a solicitor for the legal work, a mortgage broker for financing, and a property manager to handle the tenancy. Having trusted experts in your corner simplifies the entire process, from negotiating the purchase to finding reliable tenants. This support system is invaluable, providing the guidance and expertise needed to make informed decisions and handle any challenges that come your way. A coordinated team ensures every step is managed professionally, giving you the confidence to grow your portfolio.

Market Trends to Watch

Finding a great buy-to-let location isn’t just about what an area looks like today; it’s about spotting its potential for tomorrow. Getting ahead of the curve means looking for the tell-tale signs of growth that signal rising property values and strong rental demand in the future. When you know what to look for, you can identify promising areas before they hit the mainstream.

Keeping an eye on these trends will help you pinpoint locations with long-term potential. Think of it as a checklist for your research. When you see a town or city ticking these boxes, you know it’s worth a closer look. These indicators show that an area is receiving investment, attracting new residents, and building a foundation for a thriving rental market. From large-scale building projects to new transport links, these are the green flags that can point you toward your next successful investment.

Regeneration Projects

Areas undergoing significant regeneration are often goldmines for property investors. These projects can completely transform a neighbourhood, bringing in new housing, retail spaces, and improved public areas. When you see cranes in the sky and new developments breaking ground, it’s a clear sign that money is flowing into the area. These regeneration projects not only improve the quality of life for residents but also attract new people, which drives up rental demand and property values. Look for local council plans or news about major renewal schemes to identify places on an upward trajectory.

Infrastructure Investment

Pay close attention to areas with planned infrastructure upgrades. New train stations, improved road networks, or even expanded bus routes can make a location far more attractive to renters who commute for work. This kind of infrastructure investment is a powerful catalyst for growth because it improves connectivity and accessibility. An area that was once considered too far out can suddenly become a desirable hotspot with the addition of a new transport link. These developments are usually planned years in advance, giving you plenty of time to research and invest before prices start to climb.

Economic Development Zones

A simple but effective strategy is to follow the big money. When major companies and commercial developers start investing in an area, it’s a strong indicator of future economic growth. The arrival of a large corporate office, a new hotel chain, or a major retail park creates jobs and brings more professionals to the area, all of whom will need somewhere to live. This influx of jobs directly fuels the local rental market. Keep an eye on business news to see where large firms are setting up shop—it’s often a precursor to a booming property market.

Population Growth Areas

A growing population is the most fundamental driver of housing demand. You want to invest in places where people are actively choosing to live, work, and study. Larger towns and cities, especially those with universities or major employment hubs, tend to have a consistent need for rental properties. Researching population growth trends can help you identify cities that are expanding. A steady increase in population ensures a reliable pool of potential tenants, which is key to maintaining high occupancy rates and achieving a stable rental income for years to come.

Related Articles

- UK’s Best Buy-to-Let Areas by Rental Yield | Portico Invest

- Rental Yields vs. Return on Capital Invested in Buy-to-Let Properties

- Buy-to-Let Property: The Ultimate Guide for Investors | Portico Invest

- UK Buy-to-Let Property Investment: Your Essential Guide | Portico Invest

- Investor Q&A: Regional Yields vs. Capital Gains – The Rental Yield vs. Growth Trade-off Explained | Portico Invest

Frequently Asked Questions

Should I focus more on high monthly rental income or long-term property value growth? The most successful investments deliver a healthy mix of both. Think of rental income as your immediate cash flow that covers the mortgage and other expenses, while capital growth is the long-term prize that builds your wealth over time. Your personal financial goals will determine the right balance for you, but you should always consider both factors when evaluating a property.

The post mentions a 5-10% rental yield. Is anything below that a bad investment? Not necessarily. While 5-10% is a great benchmark for a strong return, it isn’t a rigid rule. For example, a property in a highly desirable, prime location might offer a slightly lower rental yield but have incredible potential for long-term value appreciation. It’s important to look at the complete financial picture of a property, including its growth prospects, rather than focusing on a single number.

I don’t live near any of the high-yield northern cities. How can I invest there effectively? You absolutely don’t need to live in the same city as your investment property. Many successful investors build portfolios from a distance by creating a reliable support network on the ground. Working with a professional property manager is key, as they handle everything from finding tenants to managing repairs, making the entire process hands-off and stress-free for you.

What’s the most common financial mistake new landlords make? One of the biggest pitfalls is underestimating the total costs involved. It’s easy to budget for the purchase price and mortgage, but many forget to account for ongoing expenses like insurance, maintenance, management fees, and potential periods without a tenant. A smart approach is to create a detailed budget that includes these costs and add a buffer for unexpected repairs.

How much time does it actually take to manage a rental property? If you decide to manage it yourself, it can be quite time-consuming. You’re responsible for everything from marketing the property and screening tenants to answering late-night calls about a leaky tap. However, hiring a property manager can turn it into a much more passive investment. They handle all the day-to-day operations, which frees you up to focus on finding your next opportunity.