Buying an investment property is fundamentally different from buying your own home. It’s not about finding a place you love; it’s about launching a small business. And like any successful business, it requires a clear strategy, a solid financial plan, and a deep understanding of your market. Your ‘product’ is the property, your ‘customers’ are your tenants, and your ‘profit’ is the rental income and capital growth. This guide will help you adopt that essential business mindset. We’ll cover everything you need to know to run your investment in buy-to-let apartments professionally, from calculating your return on investment to managing your legal duties. This is your blueprint for building a profitable property venture from the ground up.

Key Takeaways

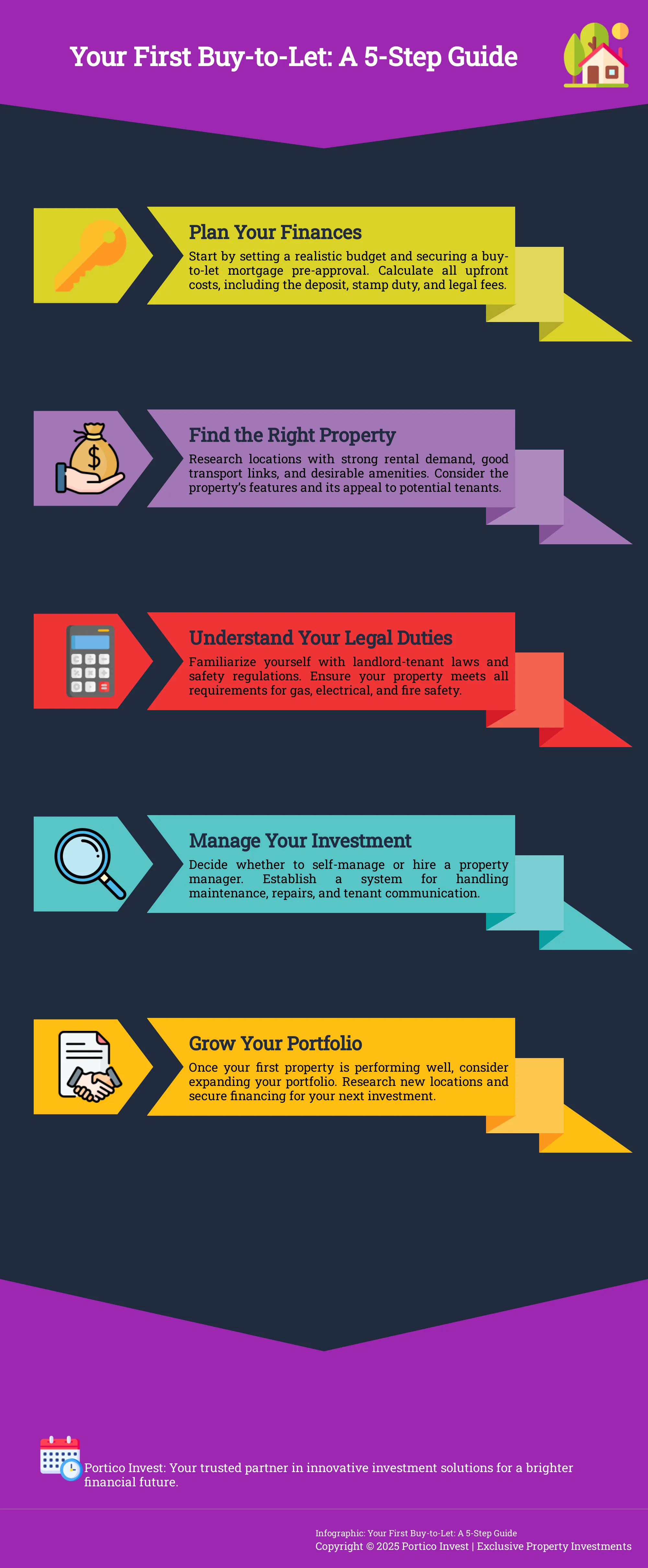

- Treat your investment like a business: A successful buy-to-let starts with a solid financial plan. Account for all costs—from the deposit and stamp duty to ongoing maintenance and potential empty periods—to ensure your property is a profitable venture.

- Think like a tenant to find the right location: The best properties are in areas where people want to live. Prioritize locations with strong job markets, excellent transport links, and local amenities to attract high-quality tenants and minimize vacancies.

- Master your landlord responsibilities early on: Being a landlord comes with legal duties designed to protect you and your tenants. Get familiar with safety regulations, insurance needs, and tenant rights to run a professional operation and avoid common pitfalls.

What Exactly Is a Buy-to-Let Apartment?

A buy-to-let (BTL) property is one you purchase with the specific intention of renting it out to tenants. Think of it as running a small business. The primary goals are twofold: to generate a steady, passive income from monthly rent and to benefit from the property’s value increasing over time, which is known as capital appreciation. It’s a popular strategy for building long-term wealth, but it comes with its own set of rules and responsibilities that set it apart from buying a home for yourself.

How Buy-to-Let Works

The process starts with finding a suitable property in an area with strong rental demand. Once you’ve found a promising spot, you’ll need to secure a special type of loan called a buy-to-let mortgage. Unlike a standard residential mortgage that’s based on your personal salary, a BTL mortgage is assessed based on the property’s potential rental income. Lenders typically want to see that the expected rent will cover the mortgage payment by about 125% to 145%. This buffer ensures the investment is financially sound and can handle periods without a tenant.

What Kind of Properties Can You Buy?

You have a lot of flexibility when it comes to the type of property you can invest in. Your options range from single-family houses and multi-unit buildings to holiday lets and apartments. Flats, in particular, are often a great starting point. They tend to attract younger professionals and students, especially in city centres where demand is high. In fact, one-bedroom flats have become an increasingly popular choice for investors because they appeal to a large segment of the rental market. Choosing the right type of property depends entirely on your budget and investment goals.

Buy-to-Let vs. Buying Your Own Home

This is a critical distinction to understand: you generally cannot live in a property purchased with a buy-to-let mortgage. The terms of the loan strictly forbid it, and doing so could be considered mortgage fraud. Owning a rental property is a business venture, not a way to get a foot on the property ladder for yourself. It comes with unique responsibilities, from finding tenants to handling repairs, and financial costs beyond just the mortgage. It’s an investment that can be incredibly rewarding, but it requires a different mindset than buying a place to call home.

Planning Your Investment

Getting your finances in order is the first major step toward buying an investment property. Before you even start looking at listings, taking the time to create a solid financial plan turns a vague goal into an actionable strategy. This isn’t just about knowing if you have enough for a deposit; it’s about understanding the entire financial picture, from securing the right mortgage to calculating your potential profits and handling your tax obligations. Think of it as building the foundation for your investment. A strong financial plan helps you set realistic expectations, make confident decisions, and avoid common pitfalls that can catch new investors off guard. It gives you clarity on what you can afford and what kind of return you can realistically expect. With a clear budget and a full understanding of the costs, you can move forward with purpose, ready to spot the right opportunity when it comes along. Let’s walk through the key financial elements you need to prepare for.

What You’ll Pay Upfront

When you’re buying an investment property, the upfront costs are a bit different from when you buy your own home. Lenders generally see buy-to-let properties as a higher risk, so you’ll need a bigger down payment to secure a mortgage. You should plan for a deposit of at least 25% of the property’s purchase price. While some lenders might consider a 20% deposit, having a larger one often gives you access to better interest rates. This initial investment is the most significant hurdle for many new investors, so it’s crucial to have your savings in order before you start your property search.

Finding the Right Buy-to-Let Mortgage

The mortgage you get for an investment property is also different. Most buy-to-let mortgages are interest-only, which means your monthly payments only cover the interest on the loan, not the loan itself. This keeps your monthly outgoings lower, which can help with cash flow. However, it’s important to remember that you’ll have to repay the entire loan amount at the end of the mortgage term. Investors typically do this by either selling the property or remortgaging. Make sure you have a clear plan for how you’ll pay back the capital when the time comes.

Don’t Forget These Extra Costs

The property price and your deposit are just the beginning. There are several other costs you need to factor into your budget. A major one is the Stamp Duty Land Tax, which includes an extra 3% surcharge for second homes and buy-to-let properties. Beyond that, you’ll also have to pay for solicitor fees, mortgage arrangement fees, and property surveys. If the apartment isn’t brand new, you might also want to set aside some money for initial redecorating or furnishing to make it attractive to tenants from day one. These costs can add up, so it’s smart to budget for them carefully.

How to Calculate Your Potential Profit

Once you have a handle on the costs, you can start thinking about your potential return. A key metric for this is rental yield, which shows you the annual return you can expect from your property. To calculate your potential return, take your expected annual rental income and subtract all your yearly running costs (like insurance, maintenance, and management fees). Then, divide that number by the total value of your property. This simple calculation gives you a clear percentage that helps you compare different properties and understand how hard your money will be working for you.

Understanding Your Tax Situation

The income you earn from rent is taxable, but it’s not as simple as paying tax on everything that comes in. The good news is that you can deduct many costs from your rental income to lower your overall tax bill. Allowable expenses often include mortgage interest, letting agent fees, insurance, maintenance, and repairs. Tax rules can be complex and are subject to change, so it’s always a good idea to speak with an accountant who specializes in property. They can help you understand your obligations and make sure you’re operating as tax-efficiently as possible.

How to Choose the Right Property

Finding the right apartment is about more than just four walls and a roof; it’s about choosing a home that will attract great tenants and deliver a solid return. This means looking at the property through the eyes of a renter and an investor simultaneously. Location, features, and market demand all play a huge role in whether your investment is a success. Let’s break down how to pick a winner.

Researching the Best Locations

The golden rule of property still holds true: location, location, location. When you’re investing, look for areas with a strong and growing job market, as this brings a steady stream of potential tenants. Excellent transport links are also a must-have, making it easy for residents to commute to work and explore the city. Don’t forget about lifestyle amenities—tenants want to live near cafes, parks, gyms, and shops. A neighborhood with a low crime rate and a vibrant community feel will always be in high demand. A great location is the foundation of a successful buy-to-let investment.

Features That Top Tenants Look For

Today’s renters have high expectations. While one-bedroom apartments are incredibly popular with young professionals and couples, the features inside are what seal the deal. Modern kitchens and bathrooms, ample storage space, and an energy-efficient design are major selling points. If the apartment has a balcony or access to a communal garden, that’s a huge bonus. For off-plan properties, pay close attention to the quality of the fixtures and fittings in the developer’s specifications. These details create a desirable living space that will help you attract and retain the best tenants for years to come.

Get to Know the Local Rental Market

Before you invest, you need to become an expert on the local rental scene. Start by researching what similar properties in the area are renting for. This will help you accurately forecast your potential income and ensure your numbers add up. It’s also crucial to understand your target tenants. Are they students, young professionals, or small families? Knowing your audience will help you choose a property that meets their specific needs. A deep understanding of the local market allows you to set a competitive rent and minimize the time your property sits empty.

Checking the Property’s Condition

With an off-plan property, you’re buying a promise of quality. That’s why it’s essential to vet the developer’s reputation and review their past projects. A high-quality build means fewer maintenance headaches and happier tenants down the line. You’ll also need to understand the ongoing costs, like ground rent and service charges, which cover the maintenance of communal areas. Finally, familiarise yourself with your legal obligations. As a landlord, you must comply with all safety regulations and landlord-tenant laws to protect both yourself and your tenants. The government’s How to let guide is an excellent starting point.

Your Legal Duties as a Landlord

Becoming a landlord is an exciting step, but it’s more than just collecting rent. When you own a buy-to-let property, you’re also taking on a set of legal responsibilities designed to keep your tenants safe and your investment secure. Think of these duties not as hurdles, but as the foundation of a successful and professional property business. Getting these right from the start protects you, your tenants, and your bottom line.

Understanding your obligations helps you avoid potential fines and legal issues down the road. It also helps you build a great reputation as a landlord, making it easier to attract and keep fantastic tenants. From safety checks to the proper handling of deposits, these rules are fairly straightforward. The key is to be organised and proactive. Whether you decide to manage the property yourself or work with a team like us at Portico Invest, knowing what’s required is the first step toward a stress-free landlord experience. Let’s walk through the main areas you’ll need to cover.

The Legal Must-Haves

First things first, you need to follow the law. In the UK, this means complying with a range of landlord and tenant laws that cover everything from how you advertise your property to how you handle the end of a tenancy. A major part of this is ensuring you provide a fair and non-discriminatory process for all potential tenants. You’ll also need to conduct regular property inspections to make sure everything is in good working order. This not only keeps your tenants happy but also helps you catch small issues before they become expensive problems. Staying on top of these core duties is essential for running a smooth operation.

Keeping Your Property Safe and Compliant

Your top priority as a landlord is providing a safe home for your tenants. This involves several mandatory safety checks. You must have a registered engineer perform a gas safety check every year and provide your tenants with the certificate. You also need to ensure all electrical systems and appliances you provide are safe, which usually means getting an Electrical Installation Condition Report (EICR) at least every five years. Don’t forget about fire safety—installing and testing smoke alarms and carbon monoxide detectors is a must. While these are legal requirements, they also give you peace of mind knowing your property and tenants are protected.

Getting the Right Insurance

Your standard home insurance policy won’t cover a rental property, so you’ll need specialised landlord insurance. This is a non-negotiable safety net for your investment. A good policy protects you from a wide range of risks, including damage to the building from events like fires or floods. It can also cover the loss of rent if your property becomes uninhabitable while repairs are being made. Crucially, it includes liability protection, which covers you if a tenant or visitor is injured on your property. Shopping around for the right policy is a small step that provides huge financial protection.

Know Your Tenant’s Rights (and Yours)

A successful tenancy is built on a clear understanding of everyone’s rights and responsibilities. You need to be familiar with the rules around things like security deposits, which must be protected in a government-approved scheme. You also need to know the proper procedures for increasing rent and the legal process for eviction, should you ever need it. The government’s How to Rent guide is an excellent resource that you are legally required to give to your tenants at the start of their tenancy. Understanding these rules helps prevent disputes and ensures you handle every situation fairly and legally.

How to Be a Great Landlord

Once you have the keys to your buy-to-let apartment, your role shifts from investor to landlord. Being a great landlord isn’t just about collecting rent; it’s about managing a valuable asset and building a positive relationship with your tenants. This means being responsive, fair, and prepared for the responsibilities that come with the territory. A happy tenant is more likely to stay longer, which means a more stable and predictable income for you.

Thinking through your management style, tenant screening process, and financial safety nets ahead of time will make your experience much smoother. It helps you handle any challenges with confidence and protects the long-term health of your investment. Let’s walk through the key areas you’ll need to master.

Should You Manage It Yourself or Hire a Pro?

One of the first decisions you’ll make is whether to manage the property yourself or hire a professional. If you live nearby and have the time, self-management can save you money. You’ll be responsible for everything from finding tenants and collecting rent to arranging repairs and handling paperwork.

However, if you want a more hands-off investment or live far from your property, hiring a property management company is a smart move. A good manager handles all the day-to-day tasks, ensuring your property is well-maintained and your tenants are happy. This is especially helpful for overseas investors or those with busy schedules who want the financial benefits of property ownership without the operational headaches.

How to Find the Best Tenants

Finding reliable tenants is crucial for a successful buy-to-let investment. The right people will pay rent on time, take care of your property, and communicate effectively. To find them, you need a solid screening process. Don’t just go with your gut feeling.

Always run thorough checks on every applicant. This should include a credit check to assess their financial responsibility, references from previous landlords to understand their rental history, and a background check for any red flags. A careful tenant screening process protects your investment and gives you peace of mind, ensuring your property is in good hands.

Handling Maintenance and Repairs

Even brand-new properties need maintenance. As a landlord, you’re responsible for keeping the apartment safe and in good working order. This means responding to repair requests promptly and planning for routine upkeep. A leaky tap or a broken appliance can become a major headache if ignored.

It’s wise to set aside a dedicated fund for these costs. A common guideline is to budget about 1% of the property’s value annually for maintenance. Another approach is to add an extra 10-20% to your budget for unexpected repairs. Having this cash reserve means you won’t be caught off guard when something needs fixing, ensuring you can maintain your property without financial stress.

What to Do When Your Property Is Empty

There will likely be times when your property is vacant between tenants. These are known as “void periods,” and during this time, you won’t be receiving rental income. However, you’ll still have to cover expenses like the mortgage, council tax, and utility bills.

Planning for these empty periods is essential for keeping your investment healthy. A good safety net is to have three to six months’ worth of expenses saved in an emergency fund. This buffer ensures you can comfortably cover all your costs without dipping into your personal savings. It removes the pressure to rush in a new tenant and allows you to wait for the right person for your property.

How to Set the Right Rent

Setting the right rent is a balancing act. If you price it too high, you might struggle to find tenants, leading to costly void periods. If you price it too low, you could be leaving money on the table and hurting your return on investment.

To find the sweet spot, you need to do your homework. Research the local market to see what similar properties in the area are renting for. Look at factors like the number of bedrooms, amenities, and proximity to transport links. Being realistic and competitive with your rental price will help you attract quality tenants quickly and maximize your rental yield.

Create Your Strategy and Manage Risks

A successful property portfolio doesn’t happen by accident. It’s built on a solid strategy and a clear understanding of the potential risks. Before you even start looking at listings, it’s essential to map out your plan. Thinking through your goals, potential pitfalls, and long-term vision will give you the confidence to make smart decisions from day one. This isn’t about predicting the future, but about preparing for it so you can handle whatever comes your way.

Define Your Investment Goals

First things first: what do you want to achieve with this investment? Are you looking for a steady monthly cash flow to supplement your income, or is your main goal long-term growth, where the property’s value increases over time? Maybe it’s a bit of both. Investing in rental properties is a fantastic way to build long-term passive income, but your success depends on having the right strategy. Knowing your primary goal will guide every decision you make, from the property you buy to the mortgage you choose.

Common Mistakes to Avoid

Learning from the missteps of others can save you a lot of headaches. A classic mistake is underestimating costs. Properties need regular maintenance and repairs, and these expenses can add up quickly if you can’t do the work yourself. Another common pitfall is being too lenient as a landlord, especially with friends or family. It’s a business, and you have to be firm about collecting rent on time and ensuring the property is cared for. Setting clear boundaries and having a separate budget for unexpected repairs will put you on the right track.

Why You Might Want More Than One Property

While one property is a great start, thinking about a portfolio can open up more opportunities. Owning multiple properties diversifies your investment and can accelerate your financial goals. You benefit from regular rental income from several sources, and the potential for capital growth multiplies. Plus, you can build significant wealth by using a mortgage to leverage your investment, meaning you own a valuable asset by only putting down a portion of its cost. Spreading your investment across a few properties also provides a safety net if one is temporarily vacant.

Plan Your Exit Strategy

It might seem strange to think about the end at the beginning, but a smart investor always has an exit strategy. How and when do you plan to sell the property or transition out of your investment? Don’t just assume you can sell the property to pay off the mortgage, especially if it’s an interest-only loan. House prices can go down as well as up. Your exit plan could be selling after a certain number of years, refinancing to pull out equity for another purchase, or holding it long-term as part of your retirement plan.

How to Grow Your Portfolio

Once you have one successful buy-to-let property under your belt, the idea of adding another becomes much less daunting. Growing your portfolio is how you build serious, long-term wealth, but it requires the same careful planning as your first purchase. The key is to replicate your successes, learn from any missteps, and scale your operations thoughtfully. It’s about making smart, strategic moves that build on your existing foundation, turning one solid investment into a thriving property business. With each new property, you’ll refine your process and grow your confidence as an investor.

Choosing Your Next Property

When you’re ready to expand, start by looking for areas with the right fundamentals. A great rental property is about more than just the building itself; it’s about the location. Look for neighbourhoods with low property taxes, good schools, and amenities like restaurants and parks that people can walk to. You’ll also want to check for low crime rates and good public transport links. A growing job market is another huge plus, as it attracts new residents and keeps demand for rentals high. Think of it as a checklist: the more boxes a location ticks, the more secure your investment will be.

Smart Financial Moves for Growth

To fund your next purchase, you need to make sure your current properties are performing at their best. Maximizing rental income is a crucial step. This involves a mix of smart property improvements, strategic pricing, and keeping your tenants happy. When you approach a lender for another mortgage, they’ll want to see that your finances are in order. A common rule of thumb is that your expected annual rental income should be at least 125% of the annual mortgage interest payments. Hitting this target shows lenders that you’re a reliable investor and makes securing your next loan much smoother.

Building Your Support Team

Growing a portfolio doesn’t mean you have to do everything yourself. In fact, scaling successfully often means getting the right help. You can choose to manage the property on your own or hire a property manager to handle everything from finding tenants to coordinating repairs. As your portfolio grows, a manager can free up your time to focus on finding the next deal. It’s also wise to connect with a mortgage broker who specializes in buy-to-let financing. They can help you understand your options and find the best loan products to support your growth strategy, saving you time and money.

Improvements That Add Real Value

When you’re trying to increase your rental income, not all renovations are created equal. Focus on improvements that tenants truly value and are willing to pay more for, like an updated kitchen, modern bathroom fixtures, or durable flooring. Before starting any work, calculate whether the potential rent increase justifies the cost. Your goal is to ensure your rent comfortably covers all your expenses—including the mortgage, taxes, insurance, and a fund for future repairs. Making strategic upgrades is one of the best ways to make sure your investment earns as much as possible over the long term.

Tips for First-Time Investor Success

Stepping into the world of property investment is exciting, but it’s also a significant commitment. The key to making it a success story is preparation. By building solid habits from the very beginning, you set yourself up for long-term gains and fewer headaches. Think of it less as a one-time purchase and more as the start of your business venture.

Focusing on a few core areas will make all the difference. You’ll want to get comfortable with market research, create a solid checklist before you buy, understand your management responsibilities, and keep a close eye on your finances. Getting these fundamentals right will give you the confidence to not only make your first purchase but also to grow your portfolio in the future. Let’s walk through what that looks like in practice.

Smart Research Habits

Before you even think about viewing a property, your first job is to become an expert on the local area. Understanding the market is about more than just looking at property prices; it’s about knowing who your future tenants are and what they’re looking for. Dive into the local rental market to get a feel for average rents, what types of properties are in high demand, and the demographics of the people living there. Are they students, young professionals, or families? This knowledge will help you choose a property that won’t just sell, but will also attract great tenants quickly.

Your Pre-Purchase Checklist

A good checklist is your best friend when buying your first rental property. It ensures you don’t miss any crucial steps in the excitement of the process. This list should cover everything from your initial financial assessment to the final legal checks. Start by confirming your budget and mortgage pre-approval. Then, as you view properties, your checklist should include items like a professional inspection, a review of the property’s history, and an analysis of potential rental income versus expenses. Following a thorough pre-purchase checklist helps you make decisions based on facts, not feelings, ensuring your investment is sound from day one.

Essential Management Skills

Once you own the property, your role shifts from buyer to landlord, and that comes with a new set of responsibilities. Being a successful landlord means staying on top of everything from legal compliance to routine maintenance. You’ll need to understand landlord-tenant laws, ensure your property meets all safety standards, and have a plan for handling repairs. It’s also crucial to screen tenants thoroughly and maintain good communication. For many first-time investors, this can feel like a full-time job, which is why many choose to work with a property management company to handle the day-to-day operations professionally.

Keeping Your Finances Healthy

A rental property is a business, and like any business, it needs careful financial management to thrive. Your top priority is to maintain a positive cash flow, meaning the rent you collect covers your mortgage, insurance, taxes, and other expenses, with some left over. It’s also essential to build a contingency fund for unexpected costs, like a boiler replacement or a vacant period between tenants. Regularly reviewing your income and expenses will help you understand your property’s performance and make smart decisions to maximize your returns. A clear financial strategy is the foundation of a healthy and profitable investment.

Related Articles

- Buy-to-Let Investing: A Practical Beginner’s Guide | Portico Invest

- Your Complete Guide to Buy-to-Let Investing | Portico Invest

- Buy-to-Let Property: The Ultimate Guide for Investors | Portico Invest

- A Guide for Savvy Investors

- UK Buy-to-Let Property Investment: Your Essential Guide | Portico Invest

Frequently Asked Questions

How much money do I really need to get started with a buy-to-let property? While the property price is the main number, your total upfront investment will be higher. A good rule of thumb is to budget for a 25% deposit, as lenders require more for investment properties. On top of that, you’ll need to cover Stamp Duty Land Tax, which includes a surcharge for second homes, plus solicitor and mortgage arrangement fees. It’s also smart to have an extra cash buffer set aside for any initial decorating or furnishing needed to get the apartment ready for tenants.

Is investing in an off-plan apartment a good idea for a first-timer? It can be a fantastic option. Buying off-plan means your property will be brand new, so you won’t have to worry about immediate repairs or renovations. Modern, new-build apartments are also highly attractive to quality tenants, which can make finding someone easier. The key is to do your homework on the developer to ensure they have a strong track record of delivering high-quality projects on time.

What if I live overseas or am just too busy to manage the property myself? This is a very common situation, and it’s exactly why property management services exist. Hiring a professional team to handle the day-to-day responsibilities turns your investment into a truly hands-off asset. A good management company will take care of everything from finding and screening tenants to collecting rent, handling maintenance requests, and ensuring all legal duties are met, giving you complete peace of mind.

What happens if my tenant stops paying rent? This is a major concern for many new landlords, but there are ways to protect yourself. The first line of defence is a thorough tenant screening process to find reliable people from the start. If you do face this issue, the process typically involves clear communication followed by a formal legal procedure. Many landlord insurance policies also offer rent protection, which can cover your income while you resolve the situation.

How long does it take for a buy-to-let property to become profitable? It’s helpful to think about two types of profit: monthly income and long-term growth. You should aim for the monthly rent to cover your mortgage and all other running costs from day one, creating positive cash flow. However, the most significant financial gains often come from capital appreciation, which is the increase in the property’s value over several years. Property is generally a long-term strategy, not a get-rich-quick plan.