You work hard for your money, and you want it to work just as hard for you. But if you’re a busy professional or living overseas, you might not have the time to manage investments day-to-day. The good news is, you don’t have to. Building an investment portfolio can be a straightforward process with the right strategy in place. It’s about creating a plan that aligns with your long-term goals without demanding all your attention. This guide will break down how to create a balanced mix of assets, including hands-off options like turn-key property investments that provide steady returns and expert management, allowing you to grow your wealth effectively.

Key Takeaways

- Start with a Personal Plan: Your financial goals, timeline, and risk tolerance are the foundation of a successful portfolio. This personal blueprint ensures your investment strategy is built specifically for the life you want.

- Build a Balanced Portfolio to Manage Risk: The core of smart investing is diversification. Spreading your money across different asset classes, such as stocks, bonds, and real estate, helps protect your portfolio from market swings and provides stability.

- Manage Your Portfolio with Discipline: Successful investing requires a long-term view. Stay on track by regularly reviewing and rebalancing your assets, and avoid emotional reactions to market changes to protect your growth.

What Is an Investment Portfolio (and Why You Need One)

Think of an investment portfolio as your personal collection of financial assets. It’s the mix of everything you own to grow your wealth—like stocks, bonds, cash, and real estate—all working together to help you reach your goals. Whether you’re saving for retirement, planning to buy a home, or simply building for the future, your portfolio is the tool that gets you there. It’s not just for seasoned experts; anyone who wants their money to work for them needs a clear strategy.

The most important reason to have a portfolio is to handle risk effectively. You’ve probably heard the saying about not putting all your eggs in one basket, and that’s exactly what a well-built portfolio helps you avoid. This strategy is called diversification. By spreading your money across different types of investments, you can better manage risk and cushion your finances from market ups and downs. If one asset class, like stocks, has a bad year, your other investments in areas like property or bonds can help balance out potential losses.

A portfolio isn’t a one-size-fits-all product. The best ones are tailored to your specific situation. Understanding your goals is the first step to building a strategy that actually works for you. Your timeline and comfort with risk also play a huge role. For example, someone saving for a down payment in three years will have a very different portfolio from someone investing for retirement in 30 years. By creating a clear plan from the start, you can make sure your investments stay aligned with what you truly want to achieve.

Set Clear Goals and Assess Your Risk Tolerance

Before you start picking investments, we need to talk about you. I know, it might feel a bit like a therapy session, but building a portfolio that actually works for you starts with understanding your personal financial landscape. It’s about getting crystal clear on what you want your money to do and how much uncertainty you can handle along the way. Think of it as drawing the map before you start the road trip. Without a destination (your goals) and an understanding of the terrain (your risk tolerance), you’re just driving blind.

This foundational step ensures that every investment choice you make is intentional and aligned with the life you want to build. It’s the difference between a portfolio that feels stressful and one that gives you confidence. Taking the time to create a financial plan provides a clear framework, helping you filter out the noise and focus on what truly matters for your future. It turns investing from a guessing game into a deliberate strategy tailored just for you. This clarity is especially crucial when you’re considering significant investments, as it helps you stay the course when markets get choppy.

Define Your Short- and Long-Term Goals

First, let’s get specific about your goals. What are you actually saving for? Maybe it’s a comfortable retirement, a down payment on your first home or an investment property, or your kids’ future education. Write them down. Next to each goal, add a timeline. When will you need the money? This is your “time horizon.” Saving for a goal that’s 30 years away, like retirement, looks very different from saving for a new car you want in three years. A longer time horizon generally gives your investments more time to grow and recover from any market dips, which influences the kind of strategy you’ll build.

Figure Out Your Risk Profile

Now, let’s talk about risk. Every investment comes with some level of it, meaning its value can go up or down. Your “risk tolerance” is simply how comfortable you are with those fluctuations. Are you someone who would lose sleep over a temporary drop in your portfolio’s value, or do you have a stronger stomach for market swings in exchange for potentially higher returns? Answering a few questions can help you determine your investor profile. There’s no right answer here. Your comfort level helps determine whether a conservative, moderate, or aggressive approach is the best fit for you. Generally, the longer your time horizon, the more risk you might be willing to take on.

What Goes Into a Diversified Portfolio?

Think of a diversified portfolio as a well-rounded team. You don’t want a team full of only star strikers; you also need solid defenders and a reliable goalie. In investing, these different players are called “asset classes.” Each one has a unique role, its own strengths, and its own risks. Spreading your money across these different classes is the core of diversification. It helps protect you from the dramatic ups and downs of any single investment type. While there are many options out there, most strong portfolios are built on a foundation of four key asset classes. Understanding what each one brings to the table is the first step in building a strategy that works for you and your financial goals. Let’s break down the main players you’ll want on your team.

Stocks and Equities

Stocks, also called equities, are your portfolio’s growth engine. When you buy a stock, you’re buying a small piece of ownership in a public company. If that company does well, the value of your piece can go up, sometimes significantly. This potential for high returns is what makes stocks so attractive for long-term goals like retirement. However, they also come with more volatility—their values can swing up and down quite a bit. The key is not to get spooked by short-term changes. Investing in a mix of different stocks across various industries is a great way to manage this risk while still giving your money the chance to grow. Different asset allocation models can show you how stocks fit into a broader strategy.

Bonds and Fixed Income

If stocks are the accelerator, think of bonds as the steady hand on the wheel. When you buy a bond, you’re essentially lending money to a government or a corporation. In return, they promise to pay you back with interest over a set period. Bonds are generally considered safer than stocks and provide a predictable stream of income, which can bring a welcome sense of stability to your portfolio. While their returns are typically lower, they often hold their value or even go up when the stock market is down. This balancing act is crucial. Including bonds helps cushion your portfolio during volatile times and provides a reliable income source, making them a vital part of any diversified plan.

Real Estate

Real estate is a powerful, tangible asset that can add another layer of diversification to your portfolio. Unlike stocks and bonds, it’s an investment you can see and touch. Property investments can generate returns in two ways: through rental income, which provides a steady cash flow, and through capital appreciation, where the property’s value increases over time. Real estate can also be a fantastic hedge against inflation, as both rental income and property values tend to rise with the cost of living. While it’s less liquid than stocks (meaning you can’t sell it in a day), its unique benefits make it an excellent component for building long-term wealth and diversifying away from the traditional stock market.

Cash and Equivalents

Finally, every good portfolio needs a safety net, and that’s where cash and cash equivalents come in. This is the most stable and accessible part of your investments. It includes money in high-yield savings accounts, money market funds, or short-term certificates of deposit. The main purpose of holding cash isn’t to generate big returns, but to provide liquidity and security. It’s the money you can access quickly for an emergency or to seize a new investment opportunity without having to sell your other assets at a bad time. Having a cash reserve protects you from market volatility and gives you the flexibility and peace of mind that are essential for any smart investor.

How to Diversify Your Investments

Diversification is a term you’ll hear a lot in investing, but it boils down to a simple, timeless piece of advice: don’t put all your eggs in one basket. It’s the most effective strategy for managing risk while still aiming for growth. Think of it as building a team where each player has a different strength, ensuring your portfolio can stand strong through market ups and downs. Getting this right is less about complex formulas and more about a thoughtful, balanced approach.

Balance Risk with Reward

The main goal of diversification is to smooth out the bumps in your investment journey. By spreading your money across various investments, you reduce the impact that any single poor-performing asset can have on your overall portfolio. If one investment zigs, another might zag, helping to stabilize your returns over time. This isn’t about eliminating risk—all investments carry some—but about managing it. It’s about finding a sweet spot where you’re comfortable with the level of risk you’re taking for the potential reward you stand to gain.

Spread Investments Across Different Asset Classes

A truly diversified portfolio includes a mix of different asset classes. The most common ones are stocks, bonds, and real estate. Each class behaves differently in various economic climates. For instance, when the stock market is volatile, bonds or property investments might provide more stability. Deciding on your mix is a personal choice based on your goals and risk tolerance. You can explore different asset allocation models to see what a balanced portfolio might look like, but a healthy blend of these core categories is a great place to start.

Diversify by Location and Industry

You can take diversification a step further by spreading your investments within each asset class. For stocks, this means investing in companies of different sizes and across various industries, like technology, healthcare, and consumer goods. It also means looking at different geographic locations. Investing internationally can be a great move, but you can also diversify geographically with property. Choosing to invest in a high-growth city like Liverpool, for example, adds a strong, localized asset to your portfolio that isn’t tied to the performance of the stock market.

Create Your Personal Investment Strategy

Okay, you’ve set your goals and you know what kinds of assets you want in your portfolio. Now it’s time to decide on your game plan. Your personal investment strategy is the rulebook you’ll follow for putting your money to work. It’s less about picking a single winning stock and more about creating a consistent approach that aligns with your life and financial goals. Having a clear strategy helps you stay the course when markets get choppy and keeps you focused on what really matters: your long-term success. Let’s look at two key decisions you’ll make when building your strategy.

Choose Your Approach: Active vs. Passive Investing

This is one of the first big choices you’ll make. Active investing is a hands-on approach where you (or a fund manager) select individual investments with the goal of outperforming the market. It requires more research and attention. Passive investing, on the other hand, is a more hands-off method. It typically involves buying index funds or ETFs that aim to match the performance of a market index, like the FTSE 100. This approach is a straightforward way to build wealth and often comes with lower fees. Neither is inherently better; the right choice depends on how involved you want to be in managing your investment portfolio.

Consider Dollar-Cost Averaging

Instead of investing a large lump sum all at once, you might want to use dollar-cost averaging. This simply means investing a fixed amount of money at regular intervals—say, £200 every month—regardless of what the market is doing. This disciplined method helps reduce the impact of volatility. When prices are low, your fixed amount buys more; when prices are high, it buys less. Over time, this can lower the average cost of your investments. It’s a powerful way to take emotion out of the equation and avoid the temptation of trying to perfectly time the market. It’s a steady approach to building your investment portfolio over the long haul.

How to Manage Your Portfolio Long-Term

Building your portfolio is a huge first step, but the work doesn’t stop there. Your investments need ongoing attention to make sure they continue to support your goals. Think of it like tending a garden; you can’t just plant the seeds and walk away. Managing your portfolio is about making small, consistent adjustments over time to keep it healthy and growing in the right direction. It’s a long-term commitment, but with a clear process, it becomes a simple and empowering part of your financial routine.

Review Your Portfolio Regularly

Life changes, and so do the markets. That’s why it’s so important to check in on your portfolio periodically. A good rule of thumb is to schedule a review at least once a year. During this check-up, you’re looking to see if your investments still align with your financial goals. Has one asset class, like stocks, grown so much that it now makes up a larger piece of the pie than you originally planned? If your portfolio has drifted from its intended mix, it might be time to make some adjustments to get back on track. This regular review ensures your investments don’t stray too far from the path you set for them.

Know When and How to Rebalance

If your yearly review shows that your asset allocation is off-balance, the next step is to rebalance. Rebalancing is less about chasing higher returns and more about managing risk. It’s the practical process of bringing your portfolio back to the risk level you initially chose. To do this, you would sell a small portion of the investments that have performed well and use that money to buy more of the assets that have underperformed or stayed flat. This might feel counterintuitive—selling your winners—but it’s a disciplined strategy that prevents one single asset class from having too much influence over your portfolio’s performance and exposing you to unnecessary risk.

Adjust for Life and Market Changes

Beyond routine rebalancing, you’ll also need to adjust your strategy when you go through major life events. Getting married, having children, or starting a new business can change your financial picture, your timeline, and how much risk you’re comfortable with. These moments are perfect opportunities to revisit your entire investment plan. It’s also why having a diversified portfolio is so crucial. Assets like stocks, bonds, and property react differently to market shifts. A stable, hands-off asset like a buy-to-let property can provide consistent returns, helping to ground your portfolio when other markets might be more volatile. This ensures your investments can weather both personal and economic changes over the long haul.

Common Portfolio Mistakes to Avoid

Building a strong investment portfolio is a marathon, not a sprint. Along the way, it’s easy to make a few wrong turns. The good news is that you can learn from the missteps of others. Knowing what to watch out for is one of the best ways to protect your hard-earned money and stay on track toward your financial goals. Let’s walk through some of the most common mistakes so you can steer clear of them.

Putting All Your Eggs in One Basket

You’ve heard the old saying, and it’s a golden rule in investing for a reason. Concentrating all your capital into a single investment or asset type is a high-stakes gamble. True portfolio strength comes from diversification, which simply means spreading your money across different kinds of investments. This way, if one area of your portfolio takes a hit, the others can help balance it out. For example, even if you’re passionate about property, a diversified approach might mean balancing your real estate holdings with stocks and bonds to manage risk effectively.

Forgetting About Inflation

Inflation is the quiet force that can slowly reduce the value of your money over time. If your investment returns aren’t growing faster than the rate of inflation, you’re actually losing purchasing power. Think of it this way: the £100 you have today won’t buy you the same amount of goods and services in ten years. Your portfolio’s job is to grow your wealth in real terms. Assets like property can be a fantastic hedge against inflation, as both rental income and property values have the potential to rise with the cost of living, helping your investment keep pace.

Letting Emotions Drive Decisions

Market fluctuations are a normal part of investing—they’re going to happen. The biggest mistake you can make is letting fear or greed dictate your actions. When the market dips, our first instinct might be to sell everything to avoid further losses. But history shows that markets tend to recover. Panicking and selling low can lock in your losses and cause you to miss the eventual rebound. Successful investing requires a steady hand and a long-term perspective. Sticking to your strategy, even when it feels uncomfortable, is often the most profitable behavioral finance approach.

Ignoring Hidden Fees and Taxes

Small percentages can make a huge difference over the long run. Investment fees, management costs, and taxes can all eat into your returns if you’re not paying attention. Before you commit to any investment, make sure you have a crystal-clear understanding of all the associated costs. Whether it’s transaction fees for stocks, expense ratios for funds, or management fees for a rental property, these costs add up. Similarly, understanding the tax implications of your investments is crucial for accurately projecting your net returns and making smart decisions for your financial future.

Helpful Tools and Resources for Managing Your Portfolio

Once your portfolio is set up, you don’t have to manage it alone. Keeping track of your investments, researching new opportunities, and staying on top of market news can feel like a full-time job, but plenty of tools and resources can make it much more manageable. Think of these as your personal finance toolkit, designed to help you stay informed and in control without the overwhelm. Whether you prefer a hands-on approach or want expert guidance, there’s something out there for you.

For those moments when you need a bit more support, a financial advisor can help you plan for big life events, handle complex financial needs, and create a clear strategy to meet your goals. They can act as a sounding board for your ideas and provide an objective perspective, which is incredibly valuable when emotions are running high. This is a great option if you’re feeling stuck or want a professional to double-check your strategy.

If you’re more of a DIY investor, several online platforms can help you monitor your portfolio. Tools like Yahoo Finance allow you to link your brokerage accounts or manually input your holdings to track performance in one place. It’s a straightforward way to see how your investments are doing and get relevant news updates that could affect your assets. For deeper analysis, Morningstar offers comprehensive data and research on stocks, funds, and ETFs. It’s an excellent resource for vetting new investment ideas and understanding the finer details of what you’re investing in. Many brokerage platforms also offer their own built-in tools to help you visualize your asset allocation and track your progress toward your financial goals.

Ready to Build Your Portfolio? Start Here.

Feeling ready to put your plan into action? Building a solid investment portfolio is one of the most powerful steps you can take for your financial future. It doesn’t have to be complicated. Here’s a straightforward path to get started.

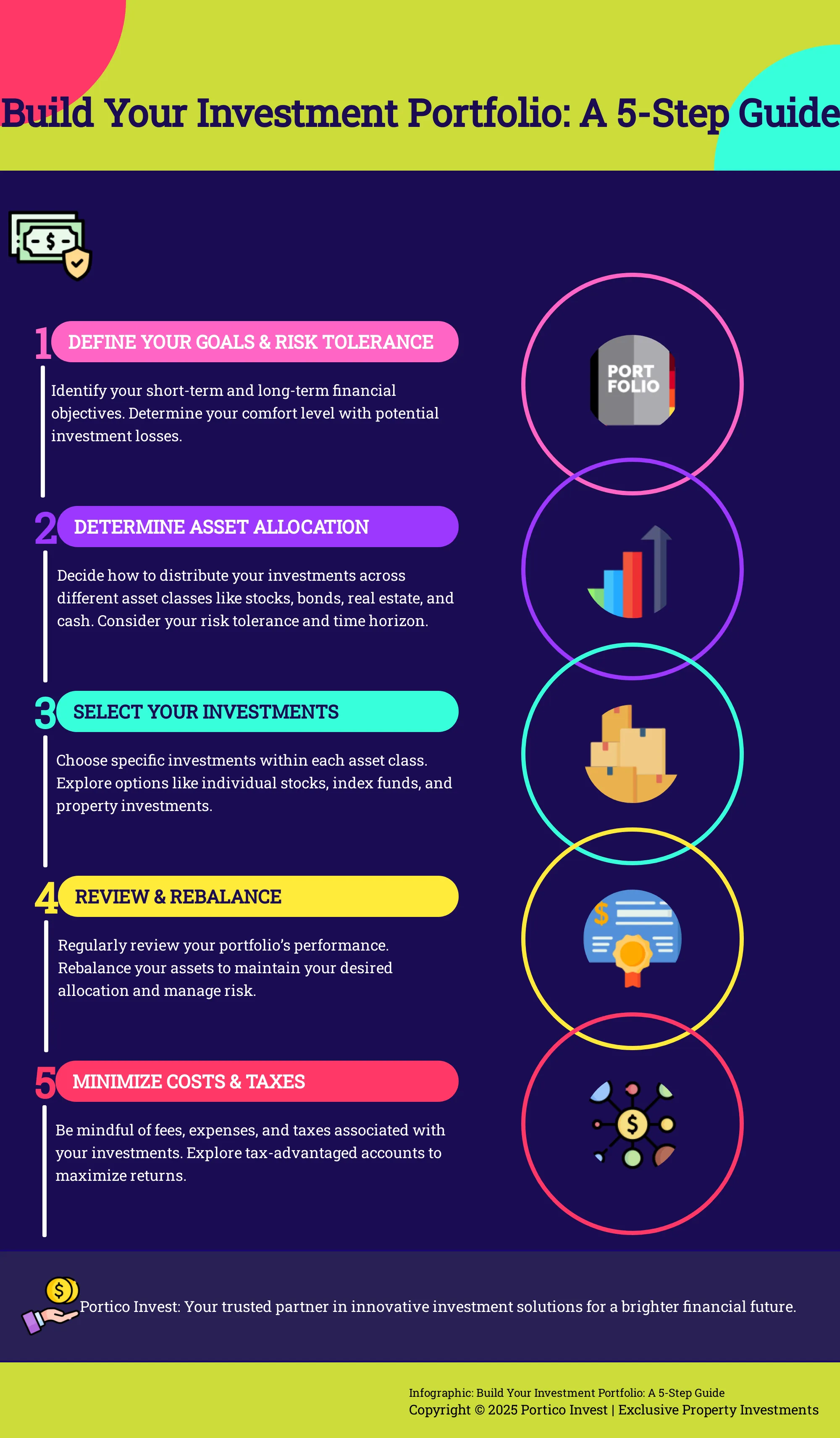

1. Establish Your Investment Profile

Before you invest a single pound, you need a clear picture of your own financial situation. This means getting honest about your goals. Are you saving for retirement decades from now, or do you need the money for a house deposit in five years? Your timeline is a key part of your investment profile, as it heavily influences your risk tolerance—how you’ll feel during the market’s inevitable ups and downs. Also, consider your income, existing savings, and any debts you have. This complete view helps you build a strategy that fits your life, not someone else’s.

2. Decide on Your Asset Allocation

With your profile set, you can decide on your asset allocation. This is just the fancy term for how you’ll split your money across different investment types, like stocks, bonds, and property. A smart asset allocation is your best tool for managing risk because these different assets don’t always move in the same direction. For instance, a common strategy is a 60/40 portfolio (60% stocks, 40% bonds), but your personal mix will depend on your risk tolerance. If you have a long time horizon, you might lean more heavily into growth assets like stocks and real estate.

3. Choose Your Investments

Now it’s time to choose the specific investments that will make up your portfolio. Within each asset class, you have options. For stocks, you could buy shares in individual companies or diversify instantly with index funds. For real estate, you might consider buying a property directly. If the idea of being a landlord sounds like too much work, you can still get the benefits of property investment. Working with a team that provides hands-off property management can be a game-changer, especially for busy professionals or overseas investors who want expert guidance without the day-to-day hassle.

4. Rebalance Regularly

Your portfolio isn’t a “set it and forget it” deal. Over time, as some investments grow faster than others, your original asset allocation will shift. This is called “portfolio drift,” and it can unintentionally increase your risk level. To stay on track, you’ll need to rebalance your portfolio periodically—usually once or twice a year. This simply means selling some of your high-flying assets and buying more of the underperforming ones to return to your target mix. It’s a disciplined way to buy low and sell high while keeping your strategy consistent with your goals.

5. Keep an Eye on Costs and Taxes

Don’t let hidden costs eat away at your returns. Fees and taxes can have a surprisingly large impact on your portfolio’s growth over the long term. Be aware of all the potential costs, including transaction fees when you buy or sell, and management fees or expense ratios for funds. It’s also smart to understand the tax implications of your investments. Whenever possible, use tax-advantaged accounts like an ISA (Individual Savings Account) to help your money grow more efficiently. A little due diligence on costs now can save you a lot of money down the road.

Related Articles

- Long-Term Investing: A Beginner’s Guide | Portico Invest

- Where to Invest in the UK for Maximum Return | Portico Invest

- How to Diversify Your Investment Portfolio with Buy-to-Let Properties | Portico Invest

- Building Your Financial Foundation: Essential Investment Basics with Portico Invest | Portico Invest

- Hands-Off Property Investment Options in the UK | Portico Invest

Frequently Asked Questions

How much money do I actually need to start an investment portfolio? There’s a common myth that you need a huge amount of cash to start investing, but that’s just not true. You can begin with whatever amount feels comfortable for you. The key is consistency, not a massive initial investment. Setting up a plan to invest a smaller, regular amount each month is a fantastic way to build your portfolio over time without feeling financially strained.

I’m interested in property, but isn’t that complicated for a first-time investor? Getting into property investment can feel like a huge undertaking, and it certainly can be if you go it alone. However, it doesn’t have to be. You can add real estate to your portfolio without becoming a full-time landlord. Working with a team that specializes in hands-off property solutions means they handle the complex parts, like finding tenants and managing the property, while you get the benefits of a tangible, income-producing asset.

How do I stop myself from panicking and selling when the market drops? This is the hardest part for almost every investor. The best defense against fear is having a solid plan. Before you invest, you define your goals and your timeline. When the market gets shaky, remind yourself of that plan. You made those decisions with a clear head, focusing on your long-term vision. Trusting your strategy is what will keep you from making emotional decisions you might regret later.

Is it better to invest a lump sum or small amounts regularly? While investing a lump sum can work well if the market goes up right after, many people prefer investing a fixed amount on a regular schedule. This approach, known as dollar-cost averaging, takes the pressure off trying to perfectly time the market. You invest consistently whether prices are high or low. It’s a disciplined strategy that smooths out the bumps and helps you build wealth steadily over the long run.

My portfolio is set up. Now what? How much time does managing it really take? Once you’re set up, managing your portfolio shouldn’t feel like a second job. The most important task is to schedule a check-in once or twice a year. During this review, you’ll see if your investments have drifted from your target mix and rebalance if needed. Aside from that, the goal is to let your strategy do its work without constant tinkering. A well-built portfolio is designed for the long haul, not for daily monitoring.