The idea of earning a passive income from property is appealing, but the reality of being a landlord can seem like a full-time job. From finding reliable tenants and handling late-night repair calls to keeping up with legal paperwork, the day-to-day responsibilities can be demanding. This is especially true if you live far from your investment or already have a busy career. The good news is that you don’t have to do it all yourself. A hands-off, turnkey approach makes investing in a buy to let property UK accessible to everyone, allowing you to enjoy the financial benefits without the stress.

Key Takeaways

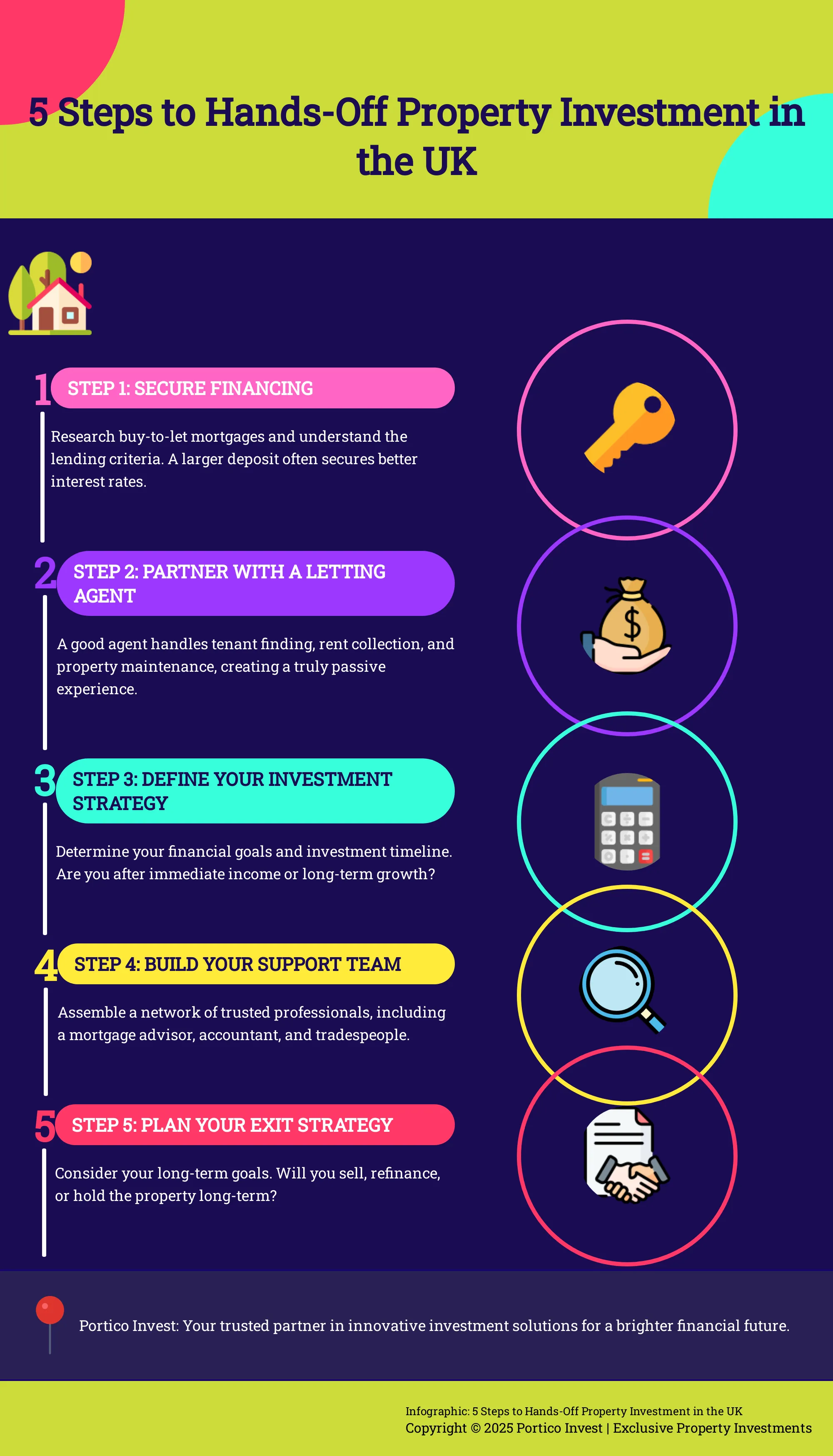

- Master your finances before you start: A successful investment is built on solid numbers. This means securing the right buy-to-let mortgage, accurately calculating your net rental yield after all costs, and setting aside a contingency fund for unexpected expenses.

- Understand your legal duties as a landlord: This isn’t just a passive investment; it’s a business with serious responsibilities. You must stay on top of mandatory safety checks, respect tenant rights, protect their deposits, and correctly report your rental income to HMRC.

- Create a clear strategy from day one: Don’t leave your success to chance. Your plan should be based on thorough research into areas with strong rental demand, a clear definition of your goals (like immediate income or long-term growth), and a well-thought-out exit strategy.

What is Buy-to-Let Property Investment?

If you’re looking for a way to generate a second income stream and build long-term wealth, you’ve probably heard the term “buy-to-let.” Simply put, a buy-to-let property is one you purchase with the specific intention of renting it out to tenants rather than living in it yourself. It’s a straightforward investment strategy that can include anything from a city-centre flat to student accommodation. For many, it’s an accessible entry point into the world of property investment, turning a physical asset into a source of regular income.

The goal is to create a business where the property pays for itself and then some. To do this, you’ll typically need a special type of loan called a buy-to-let mortgage, which is designed specifically for landlords. Getting your head around the basics is the first step, and it’s much simpler than you might think.

How Buy-to-Let Works in the UK

The process is quite logical. As the investor, you purchase a property and take on the role of a landlord. Your tenants pay you rent, usually on a monthly basis. The primary aim is for this rental income to cover all your expenses—like your mortgage payments, maintenance costs, and any letting agent fees—and still leave you with a profit at the end of the month. Unlike a standard residential mortgage that’s based heavily on your personal salary, lenders will assess your buy-to-let mortgage application based on the property’s expected rental income. This key difference is what makes property investment accessible even if you aren’t a high-earning individual.

The Pros and Cons

Like any investment, buy-to-let has its ups and downs, and it’s smart to go in with your eyes open. The biggest advantage is the potential for a consistent monthly income from rent, which can support your lifestyle or be reinvested. On top of that, there’s the possibility of capital appreciation, meaning the property’s value could increase over time, giving you a significant return when you decide to sell. However, there are risks. You might have periods without tenants, leaving you to cover the mortgage yourself. Unexpected repairs can pop up, and if you can’t meet your mortgage payments, the bank could repossess the property. Being aware of these possibilities helps you plan for them.

What to Know as a First-Time Investor

It’s easy to get swept up in the excitement, but the most successful investors are the ones who do their homework. One of the biggest property investment mistakes is rushing into a deal without thorough research. Take your time to understand the local market, the property’s condition, and all the associated costs. Many people wonder if they can get a buy-to-let mortgage as a first-time buyer, and the answer is often yes. You don’t necessarily need to own your own home first. In fact, some investors choose to rent themselves while investing in more affordable areas to get their foot on the property ladder sooner.

Getting the Finances Right

A successful buy-to-let investment is built on a solid financial foundation. Before you start viewing properties, it’s essential to get a clear picture of your budget, potential costs, and expected returns. This isn’t just about having enough for a deposit; it’s about understanding the entire financial landscape of your investment. From securing the right type of loan to accurately forecasting your rental income, getting the numbers right from the start is your best strategy for long-term success.

Think of it as creating a business plan for your property. You need to account for initial one-off expenses as well as ongoing costs like maintenance and management fees. You also need a realistic idea of the rental income you can achieve and the property’s potential to grow in value. This financial planning helps you make informed decisions and ensures your investment remains profitable. Let’s walk through the key financial steps you need to take.

Securing a Buy-to-Let Mortgage

If you’re buying a property to rent out, you can’t use a standard residential mortgage. Instead, you’ll need a specific product called a buy-to-let (BTL) mortgage. The lending criteria for these are quite different. While your personal income might be considered, lenders are primarily interested in the property’s rental potential. They’ll assess the expected rental income to ensure it covers the mortgage payments by a certain margin, typically around 125% to 145%. This gives them confidence that the property can sustain itself financially and that you’re a reliable borrower.

Understanding the Upfront Costs

Your deposit will likely be the largest single expense, and for a BTL mortgage, you’ll usually need at least 25% of the property’s value. A larger deposit can often secure you a better interest rate, which saves you money over the long term. However, the deposit is just the beginning. You also need to budget for other significant upfront costs, including mortgage arrangement fees, valuation fees, and solicitor’s fees. Remember that if you already own a property, you’ll have to pay a higher rate of Stamp Duty Land Tax on the new investment property, so be sure to factor that into your calculations.

How to Spot Market Trends

Thorough research is non-negotiable. Before making an offer, you need to understand the local rental market inside and out. Look at what similar properties in the area are renting for to get a realistic idea of your potential income. You can research local prices on property portals to get a feel for the market. Talk to local letting agents to find out what tenants are looking for—is it proximity to transport links, extra bedrooms for home offices, or outdoor space? This research is crucial not only for you but also for your mortgage lender, who will conduct their own valuation to confirm that your financial projections are accurate.

Calculating Your Rental Yield

Your rental yield is a key indicator of your investment’s performance. In simple terms, it’s the annual rental income you receive as a percentage of the property’s value. However, to get a true sense of profitability, you need to look at your net yield. This means subtracting all your annual running costs from your rental income before doing the calculation. These costs include your mortgage payments, insurance, maintenance, and letting agent fees. The goal is for your rental income to comfortably cover all these expenses, leaving you with a healthy profit each month. You must also report this rental income to HMRC on a Self Assessment tax return.

Gauging Capital Growth Potential

While rental income provides a steady cash flow, the other major way your property makes you money is through capital growth. This is the increase in the property’s value over time, which you realize when you eventually sell. While rental yield is about your immediate, monthly returns, capital growth is the long-term prize. Choosing a property in an area with strong growth potential—perhaps due to regeneration projects, new transport links, or growing employment—can significantly increase your total return on investment. It’s this combination of monthly income and long-term appreciation that makes property such a powerful asset for building wealth.

What You Need to Know About Tax

Let’s talk about the T-word: tax. It might not be the most exciting part of property investment, but getting it right from the start is crucial for your success. Understanding your tax obligations as a landlord will save you from future headaches and help you manage your finances effectively. Think of it not as a burden, but as part of the business plan for your investment.

The UK has a specific tax framework for property investors, and it’s important to know what applies to you. From the rent you collect each month to the profit you might make when you eventually sell, there are different taxes to consider. We’ll break down the main ones you’ll encounter on your buy-to-let journey, so you can feel confident and prepared. Remember, tax rules can change, so it’s always a good idea to stay informed.

Income Tax on Your Rental Income

Any money you receive from tenants as rent is considered income, and you’ll need to pay tax on it. You must declare this rental income on a Self Assessment tax return each year. The amount of tax you pay depends on your total income from all sources, which places you into a specific tax band. For most people, this will be the basic rate (20%), but higher earners will pay 40%, and additional rate earners pay 45%. It’s a straightforward process, but one you absolutely need to stay on top of to avoid any issues with HMRC.

Stamp Duty Land Tax (SDLT)

When you buy a property in the UK, you have to pay Stamp Duty Land Tax, often just called Stamp Duty. For buy-to-let investors, this is a significant upfront cost to factor into your budget. The rules state that you’ll pay a higher rate of Stamp Duty on additional properties, which includes any buy-to-let purchase. The exact amount you pay depends on the property’s price and its location within the UK, as Scotland and Wales have their own versions of this tax. Make sure you calculate this correctly when you’re figuring out the total cost of your investment.

Capital Gains Tax

If you decide to sell your buy-to-let property for more than you originally paid for it, the profit you make is subject to Capital Gains Tax. It’s not calculated on the full sale price, but on the “gain” you’ve made after deducting certain costs like the initial purchase price and fees. Everyone has an annual tax-free allowance for capital gains, which for the 2024/2025 tax year is £3,000. Any profit above this allowance will be taxed. Planning for this is especially important if you intend to sell the property as part of your long-term strategy.

Which Expenses Are Tax-Deductible?

Here’s some good news: you can lower your income tax bill by deducting certain “allowable expenses” from your rental income. This is one of the key ways to make your investment more profitable. A comprehensive buy-to-let tax guide can provide more detail, but the expenses you can typically claim include letting agent and legal fees, building insurance, council tax (if you pay it), and the costs of property repairs and maintenance. Since 2020, you can no longer deduct all your mortgage interest, but you can claim a tax credit based on 20% of your interest payments.

Keeping Up with Tax Changes

Tax legislation isn’t set in stone; governments can and do make changes to the rules for landlords. What’s true today might be different in a few years. Because of this, it’s vital to stay informed about any updates that could affect your investment. While guides like this are a great starting point, your personal financial situation is unique. We always recommend getting professional advice from a qualified accountant who specializes in property. They can help you operate in the most tax-efficient way and ensure you’re always compliant with the latest regulations.

Your Legal Duties as a Landlord

Becoming a landlord is an exciting step, but it comes with a set of legal responsibilities designed to keep both you and your tenants safe. Think of these duties not as hurdles, but as the foundation of a professional and successful rental business. Getting these right from the start protects your investment, builds trust with your tenants, and prevents costly legal issues down the line. While the list of rules might seem long, they are all perfectly manageable, especially when you have the right support system in place.

From safety checks and tenant rights to financial reporting and property standards, each requirement plays a vital role. Understanding your obligations is the first step. The next is creating a system to ensure you meet them consistently. This is where having a partner can make all the difference, turning a complex checklist into a smooth, hands-off process. Let’s walk through the key areas you’ll need to cover to be a responsible and compliant landlord.

Key Safety Regulations

Your top priority as a landlord is providing a safe home for your tenants. The law is very clear on this, and there are a few non-negotiable checks you must carry out. First, all gas appliances and flues need an annual safety check performed by a Gas Safe registered engineer. You must also ensure all electrical installations are inspected and tested by a qualified person at least every five years. Before a new tenant moves in, it’s also wise to have any provided electrical appliances checked. You are required to give your tenants copies of these safety certificates at the beginning of their tenancy.

Understanding Tenant Rights

Respecting your tenants’ rights is essential for a positive landlord-tenant relationship and for staying on the right side of the law. Before a tenancy begins, you must conduct a “Right to Rent” check to confirm your tenants are legally allowed to rent property in the UK. You also need to follow correct legal procedures for any potential issues, including evictions. This means providing the proper amount of notice and adhering to a strict legal process. The government’s How to rent guide is a helpful resource that you must also provide to your tenants at the start of their tenancy.

The Certificates and Checks You Need

Beyond safety, there are important administrative duties to keep in mind. You must inform HM Revenue and Customs (HMRC) that you are receiving income from a rental property. Each year, you’ll need to complete a Self Assessment tax return to report your rental income and pay any tax owed on your profits. Keeping detailed records of all your income and expenses from day one will make this process much easier. This includes everything from rent payments and agent fees to maintenance costs and insurance premiums, as many of these expenses are tax-deductible.

Meeting Property Standards

Your rental property must be fit for habitation and meet certain standards. A key part of this is having a formal, written tenancy agreement that outlines the rights and responsibilities of both you and your tenant. You are also legally required to protect your tenant’s security deposit in a government-approved tenancy deposit scheme. You must provide the tenant with details of the scheme you’ve used within 30 days of receiving the deposit. Failing to protect the deposit can lead to significant fines, so it’s a critical step to complete as soon as the funds are paid.

Local Licensing Rules

Finally, be aware that some rules depend on the type of property you own and its location. If your property is leasehold, you’ll likely need to get permission from the freeholder or management company before you can let it out. Additionally, if you plan to rent your property to three or more people who are not from the same household, it may be considered a House in Multiple Occupation (HMO). Many HMOs require a special license from the local council to operate legally. Licensing rules can vary between different local authorities, so always check the specific requirements for your area.

Finding the Right Property

Once your finances are in order, it’s time for the exciting part: finding the perfect investment property. This is where your research really pays off. The right property in the right location is the foundation of a successful buy-to-let business. It’s not just about finding a nice house; it’s about finding an asset that meets the needs of a specific rental market and delivers on your financial goals. Let’s walk through the key steps to pinpointing an investment that works for you.

Where to Invest in the UK

Location is everything in property investment. A great property in a poorly chosen area won’t deliver the returns you’re looking for. Focus your search on areas with strong rental demand, which are often characterized by good transport links, local amenities like shops and parks, and major employers or universities nearby. Cities like Liverpool, for example, continue to attract investment due to their growing economies and vibrant student populations. Before you get attached to a specific property, spend time researching local property prices and rental yields to identify the most promising locations. A deep understanding of the local market is your best tool for making a smart decision.

Choosing the Best Property Type

The type of property you buy will directly influence your rental income and the kind of tenants you attract. Are you targeting students, young professionals, or families? A modern one-bedroom flat near a city centre might be perfect for a young professional, while a three-bedroom house near good schools will appeal to a family. Consider the target demographic in your chosen area and what they’re looking for in a rental. The property’s size, layout, and condition all play a role. Don’t overlook newer, off-plan properties, as they often come with fewer maintenance issues and appeal to tenants looking for modern living spaces, helping you avoid common buy-to-let mistakes.

How to Assess Local Demand

A beautiful property is only a good investment if people want to live in it. Assessing local demand means digging into the data. Look at the average rental prices for different property types in your target area and check local vacancy rates—a low vacancy rate is a great sign of strong demand. See which types of properties are being rented out the fastest. Are two-bedroom flats flying off the market while larger houses sit empty? This information is invaluable. Using online property deal analyser tools can give you a clear picture of sold prices and rental trends, helping you confirm that you’re investing in a property that people actually want.

Setting the Right Rental Price

Pricing your property correctly is a balancing act. Set the rent too high, and you risk long void periods with no income. Set it too low, and you’ll hurt your rental yield and profitability. The key is to be competitive. Start by researching what similar properties in the immediate area are renting for. Look at their size, condition, and amenities compared to yours. Websites like Rightmove and Zoopla are great for this, but specialized sites can also help you compare rental prices effectively. Aim for a price that is attractive to tenants while still meeting your financial targets. Remember, a happy tenant in a fairly priced property is often better than holding out for a slightly higher rent.

Your Due Diligence Checklist

Due diligence is your safety net. It’s the process of thoroughly vetting a property before you commit to buying, and it’s one of the most important steps. A solid checklist should include inspecting the property’s physical condition (or the plans, for an off-plan purchase), understanding local market trends, and checking for any legal issues or restrictive covenants. You also need to ensure the property complies with all safety regulations, like gas and electrical safety checks. This process helps you uncover any potential problems and mitigate the risks associated with your investment. It might seem tedious, but proper due diligence protects you and your future income.

How to Manage Your Investment Property

Once you have the keys to your property, your role shifts from buyer to landlord. Effective property management is what turns a good investment into a great one, ensuring a steady income stream and protecting your asset’s value. It involves everything from finding the right tenants to handling late-night repair calls. Your approach to management will define your day-to-day experience as an investor, so it’s worth thinking about what kind of landlord you want to be from the very beginning. Are you ready to be hands-on, or would you prefer a more passive role?

Should You Self-Manage or Hire an Agent?

One of the first big decisions you’ll make is whether to manage the property yourself or hire a letting agent. If you live nearby, have a flexible schedule, and feel confident dealing with tenant issues and legal paperwork, self-management can be a rewarding option. You’ll save on fees and have direct control over your investment.

However, if you live far away, have a demanding job, or simply want a hands-off experience, a letting agent is invaluable. They handle the heavy lifting—finding tenants, collecting rent, arranging repairs, and ensuring you’re compliant with the law. A full management service typically costs between 10% and 15% of the monthly rent, but for many investors, the peace of mind is well worth the price. It’s a practical way to make your investment work for you, not the other way around.

How to Screen for Great Tenants

Finding reliable tenants who pay on time and look after your property is the goal. A thorough screening process is your best tool for this. This should always include credit checks, references from previous landlords, and confirmation of employment. While you can’t judge a book by its cover, meeting potential tenants can also give you a good sense of whether they’ll be a good fit.

Once you’ve chosen your tenant, you must get the legal paperwork right. This includes a written tenancy agreement and, crucially, protecting their deposit in a government-backed tenancy deposit scheme. Failing to do so can result in significant fines and make it difficult to regain possession of your property if issues arise later.

Staying on Top of Maintenance and Repairs

As a landlord, you have a legal responsibility to provide a safe and habitable home for your tenants. This isn’t just about fixing a leaky tap; it involves specific safety checks that are required by law. You’ll need to arrange an annual gas safety check by a Gas Safe registered engineer and ensure all electrical systems and appliances are safe.

Beyond the legal minimums, staying on top of maintenance protects your property’s value and keeps your tenants happy. Responding to repair requests promptly shows you’re a responsible landlord and can encourage good tenants to stay longer. Creating a small fund for unexpected repairs is a smart move, so you’re never caught off guard by a broken boiler or a faulty appliance.

How to Handle Empty Periods

Even with the best property, you’ll likely face periods when it’s unoccupied. These “void periods” mean you won’t be receiving rent, but you’ll still need to cover the mortgage, insurance, and council tax. The key is to factor these potential gaps into your financial planning from day one. Your rental income should be high enough to build a buffer that can carry you through a month or two without a tenant.

To keep void periods to a minimum, start marketing the property as soon as your current tenant gives notice. Make sure it’s clean, well-maintained, and competitively priced to attract new tenants quickly. A property that looks cared for is always more appealing and can help shorten the time it sits empty.

Building Your Professional Support Team

Successful property investment is rarely a solo venture. Having a team of trusted professionals around you can save you time, money, and a lot of stress. Before you even buy, you should speak with a mortgage adviser to find the right financing and a qualified accountant who can offer advice on tax.

Once you’re a landlord, your team might expand to include a reliable letting agent if you choose not to self-manage. It’s also wise to build a network of go-to tradespeople, like a plumber, an electrician, and a general handyperson you can call on for repairs. Having these contacts in place before you need them means you can handle any issue quickly and professionally, keeping both your property and your tenants in good shape.

Plan Your Strategy and Manage Risks

A successful buy-to-let journey is built on a solid strategy. While finding the right property is exciting, the real work lies in creating a plan that prepares you for the future and protects your investment. Think of your strategy as a roadmap; it guides your decisions and helps you handle any unexpected turns with confidence. A smart investor doesn’t just hope for the best—they plan for it. This means understanding the market, having a financial safety net, securing the right protection, and knowing your long-term goals from the very beginning. By thinking through these elements, you can build a resilient investment that stands the test of time and helps you achieve your financial objectives.

Preparing for Common Market Challenges

It’s easy to get swept up in the excitement of a potential deal, but one of the most common mistakes new investors make is rushing in without doing their homework. Taking the time to conduct thorough market research is essential. Look into local economic trends, infrastructure projects, and rental demand in your target area. Is the local economy growing? Are there major employers nearby? Understanding these factors helps you make an informed decision and avoid potential pitfalls down the line. A well-researched investment is always a stronger one.

Why You Need a Contingency Fund

Unexpected costs are a part of being a landlord, which is why a contingency fund is non-negotiable. This is a separate pot of money set aside specifically for unforeseen expenses. Think of it as your financial buffer for when the boiler breaks, a tenant moves out unexpectedly creating a void period, or an urgent repair is needed. Underestimating costs can quickly turn a profitable investment into a stressful one. A good rule of thumb is to have at least three to six months of rental income saved. This ensures you can cover any surprises without derailing your finances.

Getting the Right Landlord Insurance

Your standard home insurance policy won’t cover a rental property. You need specialized landlord insurance to properly protect your asset. This type of insurance is designed to cover the specific risks associated with letting a property to tenants. It typically includes buildings insurance, but you can also add coverage for loss of rent if your property becomes uninhabitable after an incident like a fire or flood. It also provides liability protection in case a tenant or visitor is injured at your property. It’s a crucial safety net for your investment.

Defining Your Investment Timeline

Before you invest, ask yourself what you want to achieve and when. Are you looking for immediate monthly income to supplement your salary, or are you focused on long-term capital growth for retirement? Having a clear investment timeline helps you set realistic goals and choose the right property. If your goal is long-term growth, you might invest in an up-and-coming area with lower initial yields. If you need income now, a property with a strong, immediate rental return would be more suitable. Your timeline shapes your entire strategy.

Planning Your Exit Strategy from Day One

Thinking about how you’ll eventually exit your investment isn’t pessimistic—it’s strategic. You should consider their exit strategy right from the start, as it will influence your purchasing decisions. Do you plan to sell the property for a profit after a certain number of years? Will you refinance it to release equity for another investment? Or do you intend to hold it for the long term and pass it on to your family? Knowing your potential exit helps you choose a property with good resale value and make informed decisions throughout your ownership.

Helpful Tools and Resources

Getting started in property investment can feel like you’re trying to learn a new language. The good news is you don’t have to figure it all out on your own. There are some fantastic tools and resources available that can help you research, plan, and manage your buy-to-let journey. Think of these as your personal support team, helping you make smarter decisions from day one. Whether you need to crunch numbers, understand market data, or get a handle on your legal duties, leaning on these resources will give you the confidence to move forward.

Platforms for Property Research

Before you even think about making an offer, solid research is your best friend. Start by getting familiar with the big property portals like Rightmove and Zoopla to see what’s on the market. But to really understand the investment landscape, you’ll want to go a bit deeper. Podcasts are a brilliant way to absorb expert advice while you’re on the go. For example, The Property Hub Podcast offers weekly insights on the UK market, covering everything from finding deals to managing tenants. Consuming this kind of content regularly will help you build a strong foundation of knowledge and stay current with market trends, so you can spot a great opportunity when you see one.

Tools for Financial Planning

Successful property investment is all about the numbers. You need a clear picture of your upfront costs, ongoing expenses, and potential income to know if a property is truly a good deal. While a simple spreadsheet can work, there are many online buy-to-let calculators that can do the heavy lifting for you. These tools help you estimate your mortgage payments, factor in costs like stamp duty and insurance, and calculate your potential rental yield and return on investment. For official guidance on the financial side of things, the government-backed MoneyHelper service provides impartial information to help you understand your commitments.

Resources for Tax Planning

Tax is an unavoidable part of being a landlord, and it’s an area where you really don’t want to make mistakes. The rules can seem complex, covering everything from income tax on your rent to Capital Gains Tax when you sell. Your first stop for reliable information should always be the official source. The GOV.UK website has dedicated sections for landlords that clearly outline your responsibilities and what expenses you can claim. While this is a great starting point, it’s also wise to consider speaking with an accountant who specialises in property. They can offer personalised advice tailored to your specific situation, ensuring you’re both compliant and tax-efficient.

Tools for Market Analysis

Once you’ve found a potential area or property, you need to analyse the market like a pro. This means looking beyond the asking price and digging into the data. How do rental yields in this postcode compare to the national average? What have similar properties sold for recently? Answering these questions is key to making a data-driven decision. A powerful tool for this is PropertyData.co.uk, which provides detailed local insights on everything from rental demand to capital growth trends. Using a platform like this helps you verify your assumptions and ensures you’re investing in an area with strong fundamentals for growth.

Solutions for Property Management

After you’ve bought your property, the real work begins. You’ll need to decide whether to manage it yourself or hire a professional. Self-management can be rewarding, but it’s also a significant time commitment that requires you to handle everything from finding tenants to fixing leaks. For many investors, especially those who live far from their property or want a more passive income stream, a hands-off approach is ideal. This is where a full-service agency comes in. At Portico Invest, we offer turnkey property management solutions that cover every detail, giving you complete peace of mind and freeing you up to focus on your next investment.

Related Articles

- UK Buy-to-Let Property Investment: Your Essential Guide | Portico Invest

- Buy-to-Let Property: The Ultimate Guide for Investors | Portico Invest

- Your Complete Guide to Buy-to-Let Investing | Portico Invest

- How to Build a Buy-to-Let Property Portfolio in 2024: Your Ultimate Guide

- Buy-to-Let Investing: A Practical Beginner’s Guide | Portico Invest

Frequently Asked Questions

Do I need to own my own home before I can get a buy-to-let mortgage? Not at all. This is a common myth, but you don’t need to be on the property ladder yourself to start investing. Lenders for buy-to-let mortgages are primarily focused on the property’s potential rental income, not your personal living situation. As long as you meet the financial criteria, such as having a sufficient deposit, you can invest in a rental property even if you’re renting the home you live in.

How much money do I really need to get started? Your largest upfront cost will be the deposit, which is typically at least 25% of the property’s purchase price for a buy-to-let mortgage. Beyond that, you need to budget for several other one-off expenses. These include Stamp Duty (at a higher rate for additional properties), solicitor’s fees, and any mortgage arrangement fees. It’s also smart to have a separate contingency fund set aside to cover any initial repairs or unexpected costs before your first tenant moves in.

What’s more important: monthly rental income or long-term property value growth? This really depends on your personal financial goals. If you’re looking for a second income stream to support your lifestyle now, then a strong monthly rental yield is your priority. If your goal is to build wealth for retirement, you might focus more on capital growth, which is the increase in the property’s value over time. The ideal investment offers a healthy balance of both, providing you with consistent cash flow while your asset appreciates in the background.

I’m worried about the legal side of being a landlord. What are the absolute must-dos? It can feel like a lot, but the core legal duties are very manageable. Your absolute priorities are ensuring the property is safe, which means getting annual gas safety checks and five-yearly electrical inspections. You must also protect your tenant’s deposit in a government-approved scheme and provide them with all the required documents, like the safety certificates and the “How to Rent” guide. Staying on top of these key responsibilities is the foundation of being a compliant and professional landlord.

Is it better to manage the property myself or hire an agent? This comes down to how much time and energy you want to dedicate to your investment. If you live close by, enjoy being hands-on, and have the flexibility to deal with tenant calls and arrange repairs, self-management can save you money. However, if you want a more passive investment, live far away, or simply don’t want the hassle, hiring a good letting agent is a game-changer. They handle everything from finding tenants to ensuring legal compliance, giving you complete peace of mind.