When you think about investing, property often comes to mind as a solid, tangible asset you can actually see and understand. Unlike the abstract nature of stocks, real estate feels grounded. But even within property, there are many paths to choose from, like buy-to-let or off-plan opportunities. This article breaks down the universal principles of smart investing and shows you how they apply directly to the property market. We’ll cover the foundational concepts you need to understand how to grow investment returns through real estate, from assessing risk in a specific location to building a balanced and profitable portfolio.

Key Takeaways

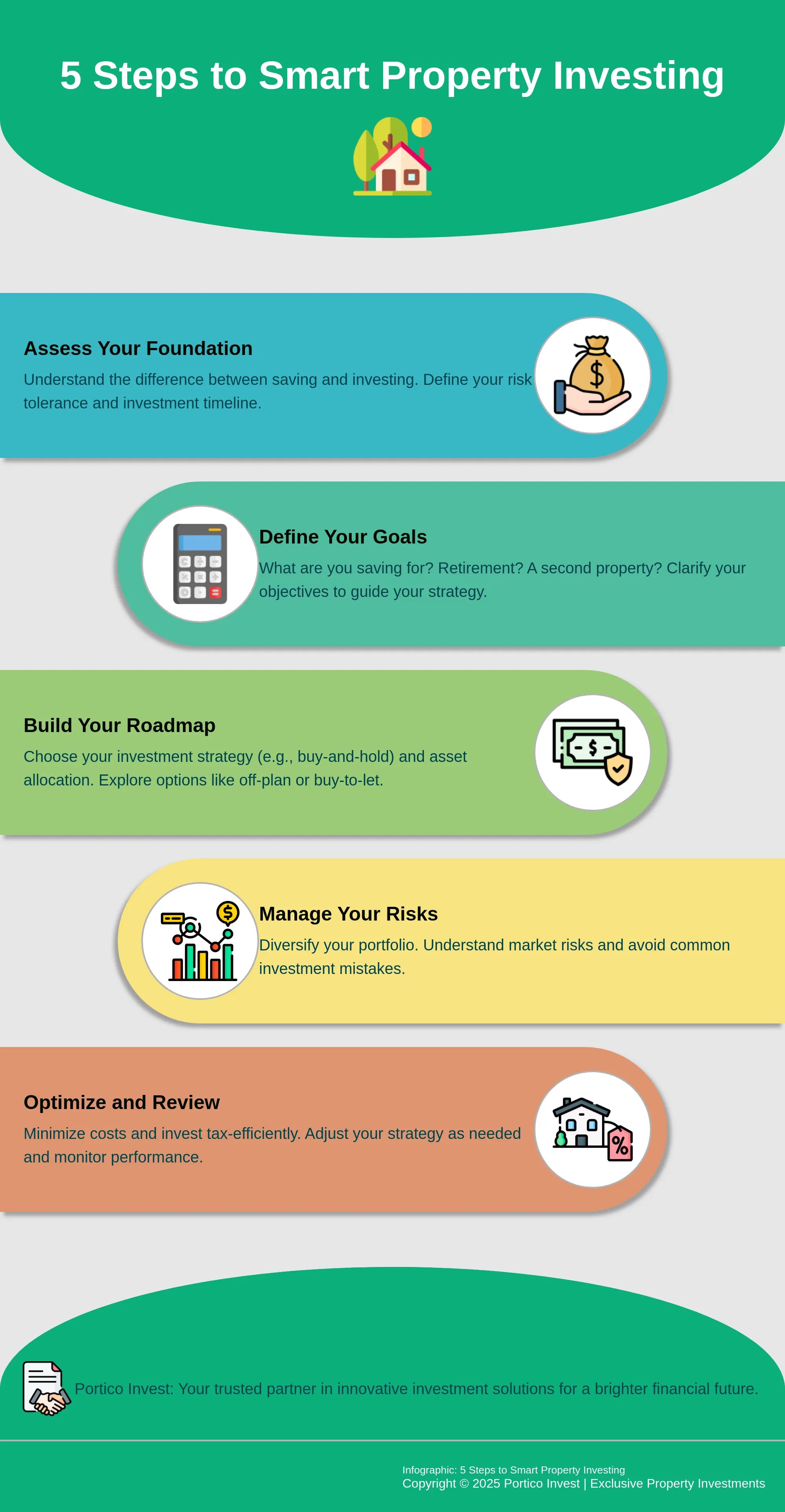

- Start with the fundamentals: Before investing, understand that it’s for long-term growth, not short-term savings. Your timeline is your most powerful tool for compounding, and your personal comfort with risk will shape your entire strategy.

- Create a clear plan based on your goals: Your investment strategy should be a direct reflection of what you want to achieve and when. A diversified mix of assets, like adding property to your portfolio, helps you manage risk while working toward those specific goals.

- Actively manage your portfolio for the long haul: Smart investing doesn’t stop after the initial purchase. Regularly review your plan, minimize costs and taxes where you can, and adjust your strategy as your life evolves to ensure your money keeps working effectively for you.

What Are the Investment Basics?

Getting started with investing can feel like a huge step, but it really boils down to a few core ideas. Think of this as your foundation—the essential knowledge you need before you start putting your money to work. It’s not about complex charts or market jargon; it’s about understanding how your money can grow and what that process looks like. Once you grasp these basics, you’ll feel much more confident making decisions that align with your financial future. Let’s walk through the three pillars of investment knowledge: the difference between saving and investing, the relationship between risk and return, and why your timing matters more than you might think.

Saving vs. Investing: What’s the Difference?

It’s easy to use “saving” and “investing” interchangeably, but they serve very different purposes. Saving is typically for short-term goals and emergencies—money you need to access easily and without risk, like a deposit for a house or a fund for unexpected car repairs. You might keep this money in a standard savings account.

Investing, on the other hand, is about long-term growth. You’re putting your money into assets like stocks, bonds, or real estate with the expectation that its value will increase over time. While investing involves some risk, it offers the potential for much greater returns than a savings account, helping you build wealth for goals like retirement or financial independence.

Understand Risk and Return

In the world of investing, risk and return are two sides of the same coin. Generally, investments with the potential for higher returns come with a higher level of risk. Safer, more stable investments tend to grow more slowly. The key is to figure out your personal comfort level with market fluctuations. Are you okay with some ups and downs for a chance at greater growth, or do you prefer a slower, steadier path?

In property investment, for example, risk can be measured in several ways. Two common metrics are the loan-to-value (LTV) ratio and the capitalization (cap) rate. Together, these figures give you a good snapshot of a property’s risk and potential return. Understanding your risk tolerance is the first step in building an investment plan that lets you sleep at night.

Why Your Timeline is Key

When it comes to investing, time is your most powerful tool. The earlier you start, the more potential your money has to grow, thanks to a concept called compound growth. This is where your initial investment earns a return, and then that return starts earning a return of its own. It creates a snowball effect that can dramatically increase your wealth over the long run.

Most investment strategies need time to work their magic. Pulling your money out too early can interrupt this growth process and may even come with penalties or fees. That’s why property is often seen as a great long-term investment—it’s an asset you can hold for years, giving it plenty of time to appreciate in value while potentially generating rental income along the way.

How Does Compound Interest Grow Your Money?

If there’s one concept that can truly change your financial future, it’s compound interest. Think of it as a snowball effect for your money. It’s not just about earning a return on your initial investment; it’s about earning a return on your returns, too. This process allows your wealth to grow at an accelerating rate over time.

Whether you’re investing in property, stocks, or other assets, understanding how compounding works is fundamental. It’s the engine that drives long-term growth and turns modest savings into a significant nest egg. The best part? It doesn’t require you to be a financial genius. It just requires time and consistency. By letting your investments and their earnings grow together, you put your money to work for you, building momentum year after year. This principle is the quiet force behind many successful investment stories.

How Compounding Works

At its core, compounding is simple: your investment generates earnings, and those earnings are reinvested to generate their own earnings. It’s a cycle of growth that builds on itself. For example, the future value of an investment can change dramatically based on the rate of return. If you invest £1,000, after 10 years at a 2% annual return, you’d have about £1,219. But at a higher rate of return, the results are staggering. This exponential growth is why compounding is often called the eighth wonder of the world. It’s a powerful reminder that consistent growth, even at a modest rate, can lead to impressive results over the long haul.

The Power of Starting Early

When it comes to compounding, time is your most valuable asset. The earlier you start investing, the more time your money has to grow. This is because the “snowball” has a longer runway to pick up speed and size. Even small, regular contributions can accumulate into a substantial sum over several decades thanks to the magic of compound growth. Someone who starts investing in their 20s has a massive advantage over someone who starts in their 40s, even if the latter invests larger amounts. It’s not about timing the market; it’s about time in the market. So, if you’ve been waiting for the “perfect” moment to start, the best time was yesterday. The next best time is today.

Reinvest Your Returns

To truly harness the power of compounding, you need to let your money do its thing. This means resisting the urge to withdraw your earnings and instead, reinvesting them back into your portfolio. For property investors, this could mean using rental income to pay down a mortgage faster or to save for a down payment on another property. For stock investors, it means reinvesting dividends. The key is to let your money stay invested for as long as possible. Patience is crucial. By consistently reinvesting your returns, you ensure that your investment base keeps growing, allowing each new bit of earnings to work even harder for you.

Which Investment Strategy Fits Your Goals?

Choosing an investment strategy is like picking a route on a map—the best one depends entirely on where you want to go and how quickly you want to get there. There’s no single “right” way to invest, but there are several proven approaches that can help you build wealth. The key is to find a method that aligns with your financial goals, your timeline, and how comfortable you are with risk. Understanding these core strategies will give you the confidence to create a plan that works for you, whether you’re focused on property, stocks, or a mix of different assets. By getting clear on your personal objectives, you can select a path that feels both smart and sustainable for the long haul.

The Buy-and-Hold Strategy

If you prefer a straightforward, long-term approach, the buy-and-hold strategy is your best friend. It’s exactly what it sounds like: you buy an asset and hold onto it for a long time, riding out the short-term market ups and downs. This method is particularly powerful in property investment, where the goal is often to benefit from long-term capital appreciation while collecting rental income along the way. Instead of trying to time the market, you trust that the value of your investment will grow over the years. It requires patience, but it’s one of the most effective strategies for steady, long-term growth.

Use Dollar-Cost Averaging

Dollar-cost averaging is a simple way to take the emotion out of investing. The idea is to invest a fixed amount of money at regular intervals, like every month or quarter. When prices are high, your money buys fewer shares or a smaller stake; when prices are low, that same amount buys more. Over time, this can lower your average purchase cost. While it’s most common with stocks, you can apply the principle to property by consistently setting aside a fixed sum for your next deposit. This disciplined approach helps you build your investment capital steadily without worrying about buying at the “perfect” moment.

Value vs. Growth Investing

Are you looking for steady income or rapid growth? Your answer will point you toward either value or growth investing. Growth investing focuses on assets in fast-growing sectors, like an off-plan property in a rapidly developing neighborhood. The potential returns are higher, but so is the risk. Value investing, on the other hand, is about finding solid, established assets that may be undervalued—think of a rental property in a stable area with consistent tenant demand. One isn’t better than the other; they just serve different purposes in a well-rounded portfolio. Many successful investors use a combination of both.

Rebalance Your Portfolio Regularly

As your investments grow, they can shift your overall asset mix. For example, if your property investments do exceptionally well, they might end up representing a much larger portion of your portfolio than you originally planned. That’s where rebalancing comes in. Periodically, you should review your investments and make adjustments to get back to your target allocation. This might mean selling a bit of an asset that has grown significantly or adding to one that has lagged. Regularly checking your investment mix ensures your portfolio stays aligned with your financial goals and risk tolerance.

Create a Strong Investment Mix

Building a strong investment portfolio is a lot like building a house—you need a solid foundation and the right mix of materials. Instead of just picking investments that sound good, a strategic approach helps you balance risk and reward to meet your long-term goals. It’s about being intentional with where your money goes. A well-constructed mix of assets can provide stability during market downturns while capturing growth when the market is strong. This balanced approach is key to creating lasting wealth without taking on unnecessary risks.

What is Asset Allocation?

Asset allocation is simply the strategy of how you divide your money among different types of investments, like property, stocks, and bonds. Think of it as not putting all your eggs in one basket. The goal is to create a mix that aligns with your financial goals and how much risk you’re comfortable with. This single decision is one of the biggest factors in how much your investments grow over time. By spreading your funds across various assets that perform differently in various market conditions, you can smooth out your returns and protect your portfolio from volatility.

Choose Your Investment Vehicles

Once you have an idea of your asset allocation, it’s time to pick your investment vehicles—the specific products you’ll use to put your money to work. These can range from stocks and bonds to mutual funds and real estate. For property, you can invest in real estate directly by purchasing a home or apartment yourself, or you can invest indirectly through funds that hold a portfolio of properties. Each vehicle has its own set of benefits and risks, so it’s important to choose ones that fit your overall strategy and what you want to achieve.

Explore Property Investment

Property is a powerful asset class for building wealth and generating income. To diversify your real estate portfolio, you can explore different types of properties. This could include residential buy-to-let apartments, commercial spaces, or even raw land. Each type offers unique advantages. For example, residential properties can provide a steady stream of rental income, while commercial properties might offer longer lease terms. By investing in a few different property types or locations, you can spread your risk and tap into multiple streams of income and growth potential.

Off-Plan and Buy-to-Let Opportunities

Two excellent strategies for property investors are off-plan and buy-to-let. Off-plan investing involves purchasing a property before it’s built, often at a lower price, which can lead to significant capital growth by the time it’s completed. Buy-to-let is focused on generating rental income by letting the property out to tenants. Success in both requires understanding local trends to find areas with strong rental demand and growth potential. Cities like Liverpool, for instance, offer exciting opportunities for both strategies, making them a smart choice for investors looking to build a robust property portfolio.

How to Manage Investment Risk

Investing always comes with some level of risk, but that shouldn’t scare you off. The key isn’t to avoid risk altogether—it’s to understand and manage it so you can invest with confidence. Smart risk management means you’re prepared for potential bumps in the road and can make clear-headed decisions that align with your long-term goals. By taking a few practical steps, you can protect your capital while still giving it the opportunity to grow. It’s all about finding a balance that lets you sleep well at night while your investments work for you.

Diversify Your Portfolio

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” That’s the core idea behind diversification. Spreading your money across different types of investments helps lower your overall risk. For example, you might invest in a mix of stocks, bonds, and property. When one asset class isn’t doing well, another often is, which helps create a more stable and balanced portfolio. Adding a buy-to-let property can be a great way to diversify your investments because it generates rental income and has the potential for long-term appreciation, acting differently than the stock market.

Understand Market Risks

Every investment type has its own set of risks. When it comes to property, it’s important to do your homework on the market before you buy. This means looking at local job growth, rental demand, and any planned infrastructure projects that could impact property values. You also need to be aware of real estate risk like changes in regulations or tax laws that could affect landlords. Working with a team that has deep local knowledge, like in a thriving city such as Liverpool, can help you get a clear picture of the market and make a well-informed decision.

Avoid Common Investment Mistakes

One of the biggest mistakes new investors make is jumping in without a solid understanding of the local market. It’s easy to get caught up in excitement, but failing to properly evaluate local trends and economic indicators can lead to poor choices. Take the time to research the fundamentals of the area you’re considering. Is the population growing? Are there diverse industries supporting the economy? Answering these questions helps you build a strong foundation for your investment and avoid costly assumptions down the line.

Assess Your Risk Tolerance

Finally, a crucial part of managing risk is knowing yourself. Your risk tolerance is your personal comfort level with the possibility of losing money for the chance of making a greater return. Are you someone who would rather see slow, steady growth, or are you comfortable with more volatility for a potentially higher reward? There’s no right or wrong answer—it’s about what fits your personality and financial situation. Understanding your willingness to accept risk will guide every investment decision you make, ensuring your strategy feels right for you.

Build Your Investment Roadmap

Think of an investment roadmap as your personal financial GPS. Without a clear destination and a planned route, you could end up driving in circles. A roadmap gives your investments purpose and direction, helping you stay on track even when the market gets bumpy. It’s a straightforward plan that outlines where you are now, where you want to go, and how you’ll get there. This isn’t about complex charts or confusing jargon; it’s about making intentional decisions that align with your life.

Creating this plan helps you filter out the noise and focus on what truly matters for your financial future. It involves setting concrete goals, understanding your timeline, deciding who you’ll work with, and scheduling regular check-ins to make sure you’re still headed in the right direction. By taking the time to build this framework, you transform investing from a guessing game into a deliberate strategy. It’s the most effective way to ensure your money is working purposefully for you, bringing you closer to your goals one step at a time.

Set Clear Financial Goals

Before you invest a single pound, ask yourself: what is this money for? Your answer is the foundation of your entire investment strategy. Having clear goals is what gives your plan direction. As the Employees Retirement System of Texas explains, investing helps you save for major life milestones, whether that’s putting a deposit on a house, planning for a comfortable retirement, or funding your children’s education.

Knowing your objective helps you choose the right path. For example, saving for a house deposit in five years requires a different approach than investing for retirement in 30 years. Be specific about what you want to achieve and when. This clarity will guide every decision you make, from the types of investments you choose to how much risk you’re willing to take.

Create Your Investment Timeline

Your investment timeline is simply how long you plan to keep your money invested before you need it. This is one of your most powerful tools, because time is what fuels compound growth. The earlier you start, the more time your money has to grow on its own. As you earn returns, those returns start earning returns of their own, creating a snowball effect that can significantly build your wealth over the long term.

A longer timeline generally means you can comfortably take on more risk, as you have more time to recover from any short-term market dips. If you’re investing for retirement decades from now, you can likely handle more volatility than someone who needs their money back in three years. Understanding your timeline helps you set realistic expectations and build a portfolio that matches your personal financial schedule.

Work with Property Investment Experts

While it’s possible to go it alone, partnering with experts can give you a serious advantage, especially in a specialized field like property. Professionals live and breathe the market every day. They can help you spot opportunities you might otherwise miss and guide you away from potential pitfalls. This is particularly true for buy-to-let or off-plan properties, where local knowledge and industry connections are invaluable.

Working with a team like Portico Invest means you have someone to handle the complexities for you, from finding promising properties to managing the entire purchasing process. Experts can help you enhance your real estate portfolio by identifying high-growth areas and ensuring your investment aligns with your long-term goals. It’s about making the process smoother, more informed, and ultimately, more successful.

Review Your Portfolio Regularly

Your investment roadmap isn’t something you create once and never look at again. Life happens—you might change jobs, get married, or have children—and your financial goals can shift. That’s why it’s so important to review your portfolio on a regular basis, perhaps once a year or after any major life event. This check-in ensures your investments are still working toward your current objectives.

During a review, you’ll want to check your investment mix to see if it still aligns with your goals and risk tolerance. For instance, as you get closer to retirement, you may want to shift toward more conservative investments. A regular review keeps your strategy relevant and effective, allowing you to make small adjustments along the way to stay on course for your financial destination.

Make Your Investments Work for You

Once your investment strategy is in motion, the journey isn’t over. Making your money truly work for you is an active process. It’s about more than just picking the right property or fund; it’s about smart, ongoing management that protects your growth from being eroded by hidden costs or taxes. By paying attention to the details, you can ensure more of your returns stay in your pocket, helping you reach your financial goals faster. Think of it as tending to a garden—the initial planting is crucial, but consistent care is what leads to a real harvest. The following steps will help you fine-tune your approach and keep your portfolio on the right track.

Minimize Your Investment Costs

Every pound paid in fees is a pound that isn’t growing for you. Over time, even seemingly small costs can have a big impact on your total returns due to the power of compounding. Whether you’re investing in property or the stock market, it’s essential to understand all the associated fees. For property investors, this includes things like service charges, maintenance costs, and property management fees. For other investments, look out for platform fees or fund expense ratios. The goal isn’t to find the absolute cheapest option, but to ensure the costs are transparent and justified by the value you receive. A clear understanding of the fee structure helps you make informed decisions and accurately project your net returns.

Invest in a Tax-Efficient Way

It’s not just about what you earn, but what you get to keep. Taxes can significantly reduce your investment gains, so it’s wise to build a tax-efficient strategy from the start. In the UK, you can use tax-advantaged accounts like an Individual Savings Account (ISA) to shield your investments from capital gains and income tax. When it comes to buy-to-let property, you can often deduct certain allowable expenses—like mortgage interest, letting agent fees, and repairs—from your rental income to lower your tax bill. Planning ahead and understanding the tax implications of your investments ensures your money is working as hard as possible for you.

Know When to Adjust Your Strategy

Your investment plan shouldn’t be set in stone. Life changes, and so do your financial goals. It’s a good idea to review your portfolio at least once a year to make sure it still aligns with your objectives and risk tolerance. A major life event, like a promotion, a new family member, or getting closer to retirement, might call for a strategic shift. This is also a good time to rebalance your portfolio. Rebalancing simply means adjusting your asset mix back to its original targets. For example, if your property investments have grown significantly, you might decide to allocate new funds to other assets to maintain a diversified investment portfolio.

Monitor Your Investment Performance

While it’s best to avoid checking your investments daily, you do need to monitor their performance over the long term. This helps you understand if you’re on track to meet your goals. Performance isn’t just about market fluctuations, which are often out of your control. It’s about how your specific assets are doing. For property investors, this means tracking rental yield, occupancy rates, and local property market trends. For other investments, you can compare your returns to a relevant benchmark, like the FTSE 100 index. Consistent monitoring gives you the information you need to make smart decisions, rather than reacting emotionally to short-term market noise.

Related Articles

- The Best Guide on How to Build a Diversified Investment Portfolio

- How to Grow Your Wealth Without Becoming a Full-Time Investor

- Building a Diversified Investment Portfolio: A Simple Guide | Portico Invest

- Long-Term Investing: A Beginner’s Guide | Portico Invest

Frequently Asked Questions

I’m nervous about losing money. What’s a good first step for a cautious investor? That’s a completely normal feeling. The key is to start with a clear understanding of your own comfort level with risk. Instead of jumping into high-growth, high-volatility options, you could begin by building a diversified portfolio that includes more stable assets. A buy-to-let property, for example, can be a great starting point because it provides a steady rental income stream and is a tangible asset, which can feel more secure than numbers on a screen.

Is it too late for me to start investing and see real growth? Not at all. While starting early gives you a longer runway, the power of compound growth works at any age. The most important thing is to simply begin. A consistent investment plan started today is far more effective than a “perfect” plan that never gets off the ground. Your timeline will influence your strategy, but significant wealth can still be built over 10, 15, or 20 years.

How does a buy-to-let property fit into a modern investment plan? A buy-to-let property is a fantastic way to diversify your portfolio. While stocks and bonds can fluctuate with the market, property often behaves differently, providing a stabilizing effect. It offers two potential returns: monthly rental income that can cover your costs and provide cash flow, and long-term capital appreciation as the property’s value increases over time. It adds a layer of tangible security and income generation that you don’t get from other asset classes.

Do I need a huge amount of money to begin investing in property? This is a common misconception. While you do need capital for a deposit, there are strategies that make property investment more accessible. For instance, purchasing an off-plan property often allows you to secure a unit at today’s price with a smaller initial deposit, with the rest of the payment due upon completion. This gives you time to save while the property is being built, making it a more manageable entry point for many first-time investors.

How often should I really be checking on my investments? It’s tempting to check your portfolio constantly, but it often does more harm than good by encouraging emotional, short-term decisions. For long-term strategies like buy-and-hold property or a diversified stock portfolio, a thorough review once or twice a year is usually enough. This gives you a chance to rebalance if needed and ensure your plan still aligns with your goals, without getting caught up in the day-to-day market noise.